All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

In May, I started covering Canadian integrated oil & gas giant Cenovus Energy (NYSE:CVE) as part of my plan to focus more on the Canadian market.

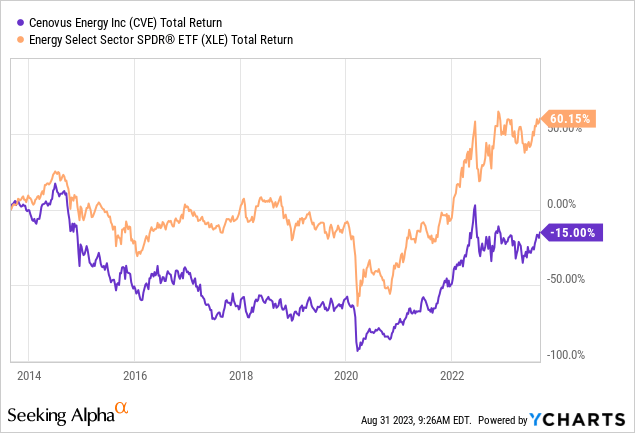

One of the issues I had with Cenovus is its poor performance. Over the past ten years, NY-listed shares have returned negative 15%, which includes reinvested dividends. This performance was way behind the already slow performance of Exxon Mobil (XOM) and Chevron (CVX)-which dominate the weightings in the Energy ETF (XLE).

The good news is that the past is in the past. Looking forward, CVE shares are in a much better spot.

Cenovus Energy, a Canadian oil major, has undergone a turnaround and is now an attractive investment. With efficient production, substantial oil reserves, and a focus on reducing debt, CVE aims to deliver value to shareholders.

It is expected to reach its net debt target by the end of this year, which will unlock a wave of cash for shareholders. This, combined with its commitment to boosting shareholder returns through dividends and potential buybacks, has contributed to its recent outperformance. – My May 2023 Article

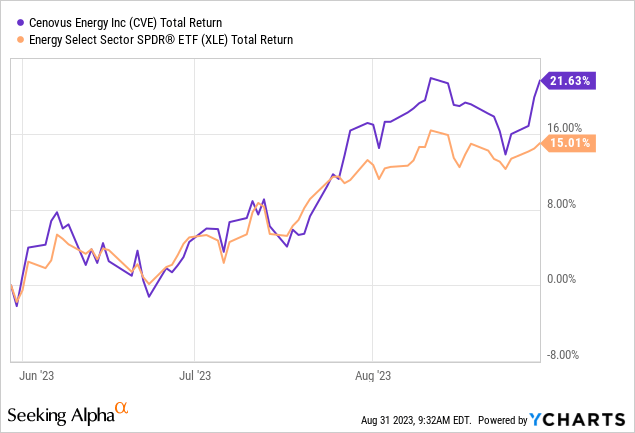

Since my article in May, NY-listed CVE shares have returned 20%. Over the past three months, CVE shares are up 22%, beating the aforementioned XLE benchmark by roughly 7 points.

In this article, I’ll update my thesis, as the good news for investors keeps coming in. The company is seeing improved operations, and we could be looking at special dividends on top of aggressive regular dividend growth and buybacks.

So, let’s get to it!

Cenovus Is Back

Cenovus is one of the few high-quality integrated oil and gas companies on the market. With a $38 billion market cap in New York, the company is the smaller peer of giants like Exxon Mobil and Chevron.

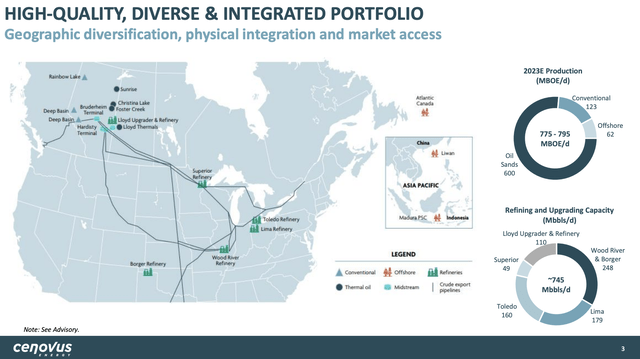

This year, the company is expected to produce 785 thousand barrels of oil equivalent per day. Roughly 600 thousand barrels of oil are expected to come from its oil sands operations.

Cenovus Energy

Furthermore, in light of my oil thesis of long-term supply growth challenges and ongoing demand growth, it needs to be said that Cenovus has top-tier assets with long reserve lives.

Whereas most shale companies are slowly running out of Tier 1 drilling assets, Cenovus has close to 9 billion barrels of oil equivalent in proven reserves. This translates to roughly 31 years without incorporating consistently rising new discoveries.

On top of that, the company has refining exposure through six refineries. These have the capacity to turn roughly 745 thousand barrels into value-added products each day.

During the second quarter, the company mentioned progress in its operations. All U.S. refining assets are now fully operational. Furthermore, the Canadian refining assets are fully operational and expected to maintain high utilization rates through the remainder of this year.

Overall, I’d say we achieved everything we set out to do in the downstream during the second quarter. and we’re very confident in our ability to produce reliably and profitably through the remainder of 2023. – CVE 2Q23 Earnings Call

In its upstream operations (oil production), the company’s sand assets are running at pre-turnaround rates, with a strong execution expected in the remainder of the year. The impact of wildfires was roughly 10 thousand barrels of oil equivalent per day.

At our oil sands assets, we safely completed a large turnaround at Foster Creek early in the quarter. The turnaround was on schedule and on budget, and the asset is now running at pre-turnaround rates. Our focus through the quarter has been on continued execution of projects that support our short- and long-term production volumes with our new well pads progressing as planned. – CVE 2Q23 Earnings Call

However, in the Asia Pacific region, the company faced challenges resulting in lower volumes due to planned and unplanned outages. An unauthorized vessel collision with an umbilical line at the Liwan 29-1 field caused a shutdown of subsea wells.

Despite this incident, production was restored by the first week of June, with no environmental impacts observed.

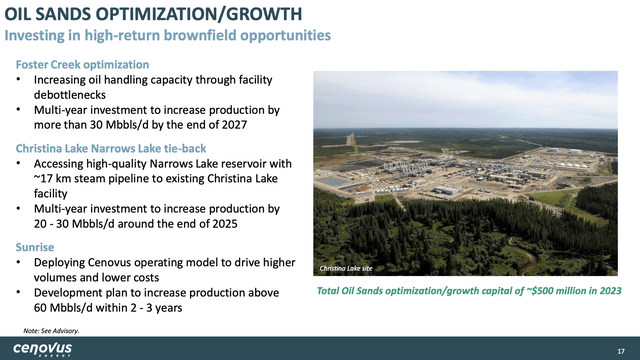

Going back to Foster Creek, this asset is expected to see a production increase of more than 30 thousand BOE by the end of 2027. Christina Lake and Sunrise are also expected to see production growth over the next 2-3 years.

Cenovus Energy

Going forward, I expect Canadian players to increasingly use their advantage of being able to boost production without having to be careful due to resource depletion.

Having said that, in the second quarter, the company continued to reduce debt. It generated roughly $900 million in free cash flow, allowing it to reduce net debt by $275 million to $6.4 billion.

The company also repurchased outstanding warrants and boosted its dividend. Buying back warrants allowed the company to reduce the diluted share count by roughly 2.4%.

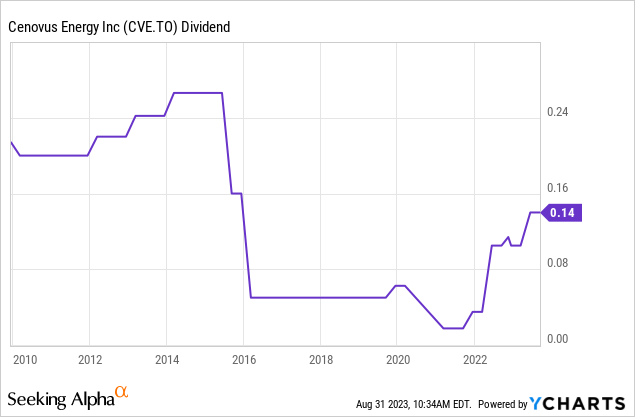

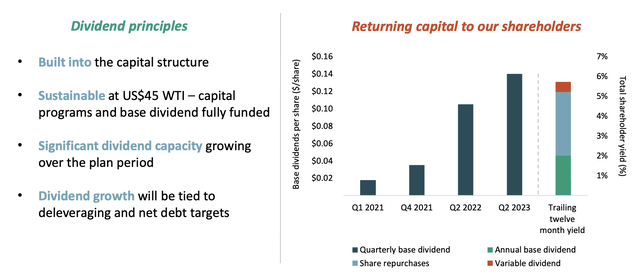

Speaking of dividends and buybacks, the company hiked its dividend by 33% on April 26, resulting in a dividend of $0.14 per Toronto-based share per quarter.

This translates to a base dividend yield of 2.1%.

2.1% is boring and nothing to write home about.

However, there’s a lot more where that came from.

Thanks to an increasingly healthy balance sheet and high free cash flow due to elevated oil prices, shareholders are in an increasingly good spot.

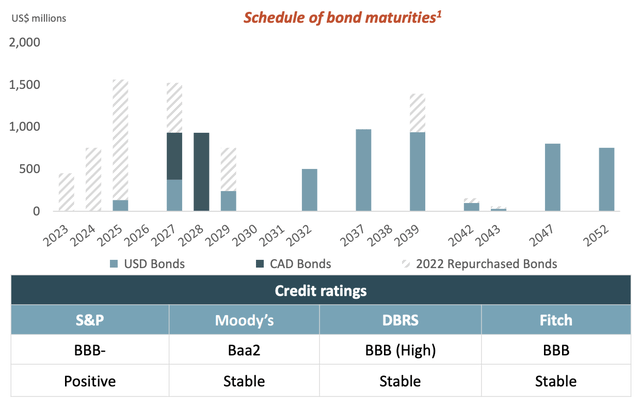

As of the second quarter, the company has a BBB-rated balance sheet with no major debt maturities until 2027.

The average weighted maturity of its debt is now 14.1 years, which is remarkable.

Cenovus Energy

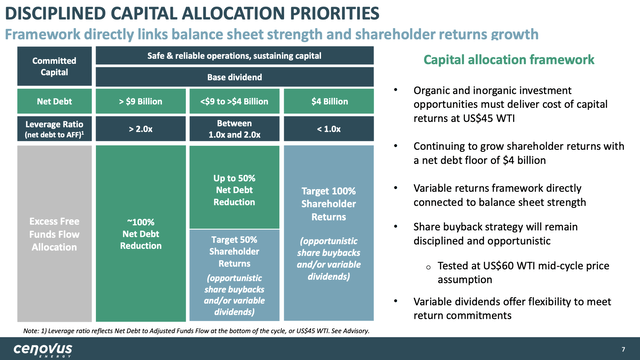

Having said that, the company has a clear framework. Currently, the company has $6.4 billion in net debt, which means it uses roughly half of its free cash flow (after its base dividend) to reduce debt. The other half is used for buybacks and special dividends.

In the second quarter, all of its excess cash (after debt reduction) went to buybacks.

Once the company has lowered net debt to $4 billion, it aims to distribute every single penny of free cash flow to shareholders. This is one of the most shareholder-friendly plans in the entire oil and gas industry.

Cenovus Energy

Bear in mind that once the company has achieved its desired net leverage target, there’s no need to reduce debt even further. After all, no major M&A is needed to keep operations running for many decades.

Analysts expect the company to reach its leverage target in 2025, which I expect to be reached next year, as I believe that oil prices will remain elevated, allowing the company to generate more free cash flow than expected.

Furthermore, the company commented on the use of special dividends to distribute cash. In the oil and gas sector, I LOVE special dividends as a way to get rid of excess cash. I don’t care much for buybacks in this cyclical industry.

Below is a conversation between Menno Hulshof, an analyst at TD Securities, and Jonathan McKenzie, Cenovus’ President & CEO. Mr. Hulshof asked about the use of special dividends during the 2Q23 earnings call (my emphasis added):

Menno Hulshof

Okay. Yes. And maybe I’ll just follow up with a question on shareholder capital returns. You’ve made it clear on many occasions that the relative economics of buybacks are tested at mid-cycle $60 WTI. But today, we’re sitting at about $80. The stock is off if it’s low. So my question is, how are you thinking about buybacks versus a variable dividend? And I’m asking that with the understanding that we’ve only seen one variable dividend since the return framework was finalized.

Jonathan McKenzie

Yes. Nothing changes in our framework, Menno. We screen all our capital at $45. We screen our buybacks at $60. We still think those are sort of the right low cycle and mid-cycle prices. I think I’m looking at Kam and he’s nodding his head. I’m looking at Jeff and he’s nodding his head. But I think with where our share price is today, we’re still more inclined to return capital to shareholders in the form of buybacks and at the share price today, in our view, doesn’t reflect the net asset value at $60.

So I think you’re going to continue to see that until we continue to see shareholder returns come back in the form of largely buybacks until we get there. But we’ve been pretty clear on the framework. If we get to the point where we think it’s in excess of mid-cycle pricing or the discounted value of the shares are in the excess of mid-cycle pricing. I think you’ll see a greater majority of the returns come back in the form of special dividends.

In other words, Cenovus believes that the mid-cycle price is still close to $60. Even based on that assumption, the company believes that its shares are significantly undervalued, meaning it will prioritize buybacks over special dividends.

Once its share price becomes less attractive, special dividends make more sense.

Technically speaking, I agree with this. It seems like the way to go and a win-win for long-term shareholders either way.

Imagine you’re buying now. The company buys back stock to boost its share price. Once the share price is high enough, special dividends are used to get rid of cash. That’s a win for shareholders, as they are likely sitting on a very juicy yield on cost.

Adding to that, the company’s dividend is sustainable at prices as low as $45 WTI, which is impressive. This also beats a lot of pure-play upstream companies.

Cenovus Energy

This brings me to the valuation.

Valuation

The valuation part of stocks tied to the price of certain commodities is tricky. After all, even small changes in the price of the underlying commodity can have a major impact on expected sales, EBITDA, net income, you name it.

In the case of CVE, the company is expected to generate $6.3 billion in free cash flow next year – using the current oil price trajectory.

This would translate to a free cash flow yield of 12%.

I believe that is attractive but not close to what the company can generate if oil prices remain elevated.

It also means that after 2024, shareholders are in a great place to receive a double-digit distribution yield, consisting of dividends and buybacks – eventually, special dividends will be added.

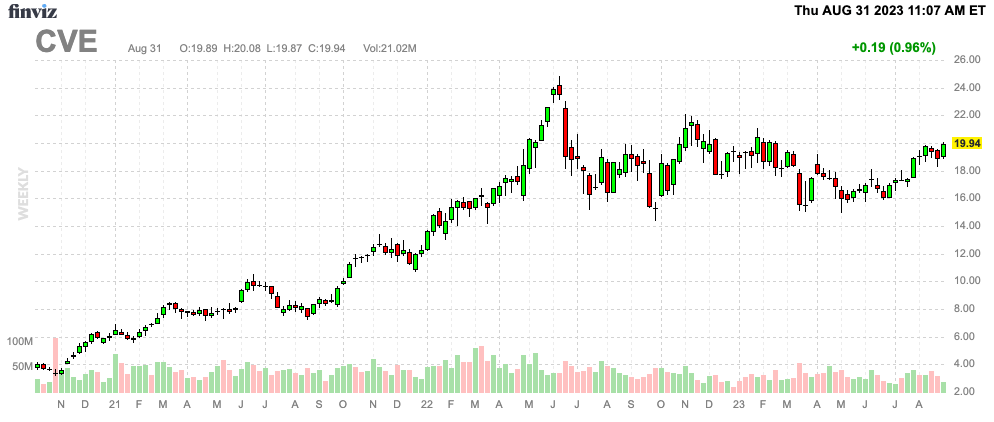

NY-listed shares are currently trading at $20, which is 10% below the current consensus price target of $22.

While I cannot predict what oil prices will do over the next few quarters – I have a longer-term view – I believe that CVE shares are poised to move towards $26 in the next 12 months.

FINVIZ

My strategy for oil and gas remains unchanged. In light of general economic challenges, I buy corrections. I bought in recent months and will buy again if we see 10-20% weakness in certain oil stocks. This would apply to CVE as well.

Takeaway

In my recent analysis of Canadian integrated oil & gas giant Cenovus Energy (in May), I noted a remarkable turnaround. Despite past underperformance, the company is now shining with efficient production, substantial oil reserves, and a debt reduction focus.

Shareholders are set to benefit from CVE’s focus on reaching its net debt target by year-end, with potential buybacks and special dividends on the horizon after an impressive 33% dividend boost.

With improved operations, projected production growth, and a clear capital return framework, Cenovus is poised to deliver significant returns in the energy market.

Personally, I remain bullish, foreseeing CVE shares potentially reaching $26 within the next year.

Read the full article here