This article is part of a series that provides an ongoing analysis of the changes made to Ruane, Cunniff & Goldfarb’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 8/14/2023. Please visit our Tracking Ruane, Cunniff & Goldfarb’s Portfolio article for an idea on their investment philosophy and our previous update for the moves during Q1 2023.

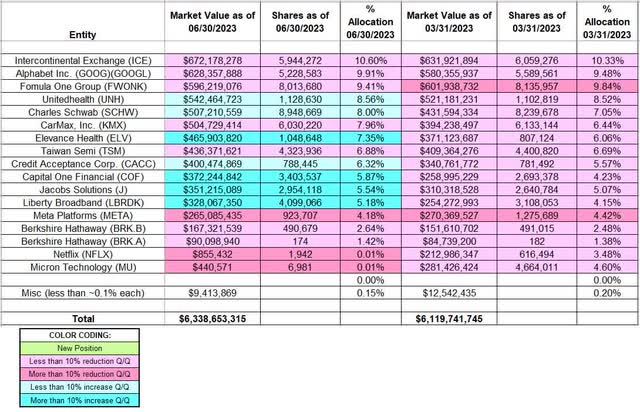

This quarter Ruane, Cunniff & Goldfarb’s 13F portfolio value increased ~4% from $6.12B to $6.34B. The number of holdings increased from 31 to 34. 17 of those stakes are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The top three positions are at ~30% while the top five are at ~47% of the 13F assets: Intercontinental Exchange, Alphabet, Formula One Group, UnitedHealth, and Charles Schwab.

The firm is best known as the investment advisor of the Sequoia Fund (MUTF:SEQUX) which has a venerable ~53-year track record (July 15, 1970 inception, 13.05% annualized return compared to 11.07% for the S&P 500 index). The performance for 2022 was terrible: Negative 30.52% compared to Negative 18.11% for the S&P 500 index. For H1 2023, they again underperformed the S&P 500 Index: 12.91% vs 16.89%. After new management took over in Q1 2016, the portfolio has seen a significant shift to information & services businesses from asset-intensive manufacturing & retail. Also, the cash allocation which had averaged ~20% since inception is now less than 5%. The following significant stakes in Sequoia’s portfolio are not in the 13F report as they are not 13F securities: Constellation Software (OTCPK:CNSWF), Eurofins Scientific SE (OTCPK:ERFSF), Lumine Group (OTCPK:LMGIF), Rolls-Royce Holdings plc (OTCPK:RYCEY), SAP SE (SAP), and Universal Music Group (OTCPK:UMGNF). Bill Ruane was a Benjamin Graham pupil. To learn about Benjamin Graham’s teachings, check out the classics The Intelligent Investor and Security Analysis.

Stake Increases:

UnitedHealth (UNH): UNH is a large (top five) 8.56% of the portfolio stake. It was established in Q4 2019 at prices between $215 and $296 and increased by ~300% next quarter at prices between ~$195 and ~$305. Q3 2020 saw a ~30% stake increase at prices between ~$291 and ~$324. There was a ~25% selling in Q2 2022 at prices between ~$452 and ~$546. That was followed with a ~15% reduction during Q4 2022 at prices between ~$499 and ~$555. The stock currently trades at ~$481. There was a ~2% trimming last quarter and a similar increase this quarter.

Charles Schwab (SCHW): SCHW is now at ~8% of the portfolio. It was first purchased in Q2 2016 at a cost-basis of ~$29. Q1 2020 saw a ~40% stake increase at prices between $28.50 and $49. There was a ~17% selling next quarter at prices between $32.50 and $43. The stock is now at $57.73. The last several quarters saw minor trimming while this quarter there was a ~9% stake increase.

Elevance Health (ELV): The 7.35% ELV stake was established in H1 2021 at prices between ~$288 and ~$402 and it is now at ~$439. Q2 2022 saw a ~42% reduction at prices between ~$444 and ~$530. That was followed with a ~16% selling during Q4 2022 at prices between ~$454 and ~$547. There was a ~30% stake increase this quarter at prices between ~$436 and ~$496.

Credit Acceptance Corp. (CACC): CACC is a 6.32% stake established in Q1 2017 at prices between $185 and $221. There was a ~25% stake increase in Q4 2020 at prices between $288 and $356. Q3 2021 saw a ~18% selling at prices between ~$438 and ~$670. That was followed with a one-third reduction next quarter at prices between ~$582 and ~$696. The stock is now at ~$487. The last five quarters saw minor trimming while this quarter there was a marginal increase.

Note: They have a ~6% ownership stake in Credit Acceptance Corp.

Capital One Financial (COF): COF is a 5.87% of the portfolio position established during Q3 2022 at prices between ~$91 and ~$116 and the stock currently trades at ~$102. There was a ~25% stake increase this quarter at prices between ~$86 and ~$114.

Jacobs Solutions (J) previously Jacobs Engineering: J is a 5.54% long-term stake first purchased in 2012. Recent activity follows: Q2 2018 saw a ~20% increase at prices between $56.50 and $67 while the next six quarters saw minor trimming. There was a ~25% selling in Q1 2020 at prices between ~$63 and ~$104. That was followed with a similar reduction in Q2 2021 at prices between ~$129 and ~$143. The stock currently trades at ~$132. The last seven quarters saw minor trimming while this quarter saw a ~12% increase.

Liberty Broadband (LBRDK): LBRDK is a 5.18% of the portfolio position purchased in Q1 2018 at prices between $86 and $97 and increased by ~20% next quarter at prices between $69 and $85. Q1 2020 saw a ~18% reduction at prices between ~$91 and ~$139. There was a ~23% stake increase in Q1 2021 at prices between ~$143 and ~$157. This quarter saw another one-third increase at prices between ~$71 and ~$85. The stock currently trades at $92.62.

Stake Decreases:

Intercontinental Exchange (ICE): ICE is currently the largest 13F position at 10.60% of the portfolio. It was purchased in Q3 2020 at prices between ~$92 and ~$107. There was a ~90% stake increase in Q2 2022 at prices between ~$90 and ~$133. The stock currently trades at ~$115. The last four quarters have seen a ~9% trimming.

Alphabet Inc. (GOOG) (GOOGL): GOOG is now at 9.91% of the portfolio. It was first purchased in 2008 and that original stake was almost sold out the following year. In 2010, a much larger position was built in the low-teens price-range. Recent activity follows: Q2 2019 saw a one-third reduction at prices between ~$52 and ~$64. That was followed with a ~60% reduction over the six quarters through Q4 2020 at prices between ~$53 and ~$107. The last five quarters saw a one-third reduction at prices between ~$83 and ~$128. The stock currently trades at ~$139.

Formula One Group (FWONA) (FWONK): Sequoia’s Q4 2016 letter disclosed a new stake in Liberty Media Formula One. They participated in Liberty’s acquisition of Formula One and acquired the shares at a discounted price of $25. There was a 24% stake increase in Q2 2017 at prices between $30.50 and $37. The six quarters through Q3 2019 saw a ~18% selling at prices between $28.50 and $43 and that was followed with similar selling next quarter at prices between $40 and $46. There was a ~17% reduction last quarter at prices between ~$53 and ~$68. FWONA is currently at $60.22. The stake is now a large (top three) position at 9.41% of the portfolio. There was a minor ~2% trimming this quarter.

Note: their ownership stake in Formula One Group is ~4%.

CarMax Inc. (KMX): KMX is currently at ~8% of the 13F portfolio. It was purchased in Q2 2016 at prices between $46 and $56 and increased by ~70% in Q4 2016 at prices between $48.50 and $66. Q4 2017 saw a ~30% selling at prices between $64 and $77 while next quarter there was a ~80% increase at prices between $59 and $72. The eleven quarters through Q4 2020 had seen a ~45% selling at prices between ~$44 and ~$109. The stock is now at ~$82. The last several quarters have also seen minor trimming.

Taiwan Semi (TSM): The 6.88% of the portfolio TSM stake was purchased in Q4 2019 at prices between $46.50 and $59. There was a ~130% stake increase in Q2 2020 at around the same price range. Q1 2021 saw a ~12% selling while in Q3 2021 there was a ~20% stake increase. Q3 2022 saw a ~30% selling at prices between ~$69 and ~$92. The stock currently trades at ~$88. The last few quarters saw minor trimming.

Note: their investment thesis is based on the following: fabs are capital intensive (~$10B per facility) and the leader naturally has a strong moat thereby yielding big profit margins. Debatably, they produce the most important manufactured component in the modern economy. It is essentially a monopoly, and the main concern is geopolitical risks.

Meta Platforms (META): The 4.18% META position saw a whopping ~600% stake increase in Q1 2018 at prices between $152 and $193. The next two quarters saw another ~27% increase at prices between $155 and $218. Q1 2019 saw an about turn: ~23% reduction at prices between $124 and $173. Q1 2021 saw a ~13% stake increase at prices between ~$246 and ~$299. Q3 2022 also saw a ~11% stake increase. The last two quarters saw a ~70% selling at prices between ~$125 and ~$289. The stock currently trades at ~$305.

Berkshire Hathaway (BRK.A) (BRK.B): Berkshire stake is now at ~4% of the portfolio. It is a very long-term position that was the largest stake in their first 13F filing in 1999. Recent activity follows: Q1 2018 saw a one-third selling at prices between ~$191 and ~$217. The nine quarters through Q1 2022 had seen the large stake sold down at prices between ~$169 and ~$359. Next quarter saw another one-third selling at prices between ~$268 and ~$353. The stock is now at ~$370. The last four quarters also saw minor trimming.

Netflix (NFLX): NFLX position was purchased in Q4 2020 at prices between ~$471 and ~$554. There was a ~15% stake increase in Q2 2021 at prices between ~$485 and ~$555. That was followed with a ~85% stake increase in Q1 2022 at prices between ~$331 and ~$597. Next quarter also saw another ~45% stake increase at prices between ~$166 and ~$392. Q3 2022 saw an about turn: ~40% selling at prices between ~$174 and ~$249. That was followed with another ~50% reduction next quarter at prices between ~$214 and ~$320. The stake was almost sold out this quarter at prices between ~$318 and ~$445. The stock currently trades at ~$396.

Micron Technology (MU): MU position was built over the two quarters through Q3 2021 at prices between ~$74 and ~$96 and the stock currently trades well below that range at $70.71. Q3 2022 saw a one-third reduction at prices between ~$49 and ~$65. The position was almost sold out this quarter at prices between ~$57 and ~$74.

The spreadsheet below highlights changes to Ruane, Cunniff & Goldfarb’s 13F stock holdings in Q2 2023:

William J. Ruane – Ruane, Cunniff, & Goldfarb – Sequoia Fund’s Q2 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Ruane, Cunniff & Goldfarb’s 13F filings for Q1 2023 and Q2 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here