Thesis Summary

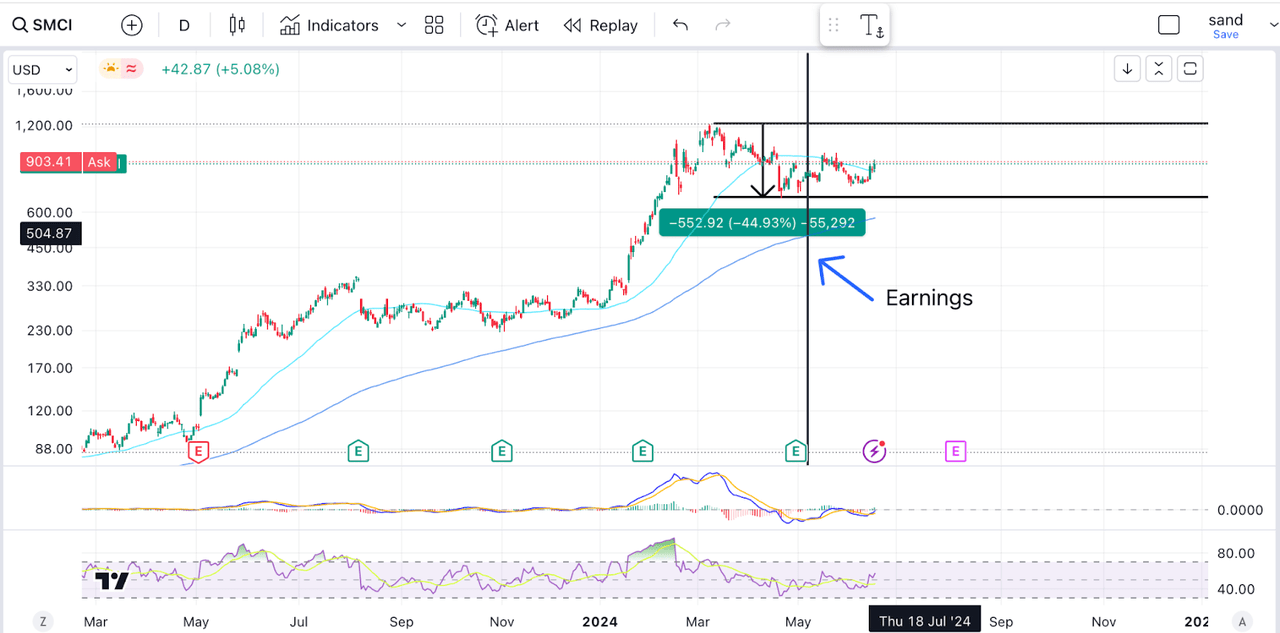

Super Micro Computer, Inc. (NASDAQ:SMCI) has rallied strongly in 2024, but also sold-off over 40% since reaching a peak.

However, the stock looks like a solid buy if we look at its earnings, future outlook, valuation and also technical analysis.

In my last article on SMCI, I compared the company to Nvidia Corporation (NVDA), giving it a hold rating. However, this was when the stock traded near $1300.

The stock is now more fairly priced, while the growth story is supported by evidence that liquid cooling demand is going to keep increasing.

I am upgrading SMCI to a buy.

Latest Earnings

SMCI has experienced a substantial selloff since it peaked at near $1300.

SMCI Price (TV)

Though the stock is still up massively in the last year, it actually fell almost 50% from its top. The stock actually sold off heading into earnings, which were released at the end of April, and has since seen somewhat of a reversal, though we could say the stock is still consolidating.

Ultimately, if we look at the latest earnings, there’s plenty to get excited about when it comes to SMCI.

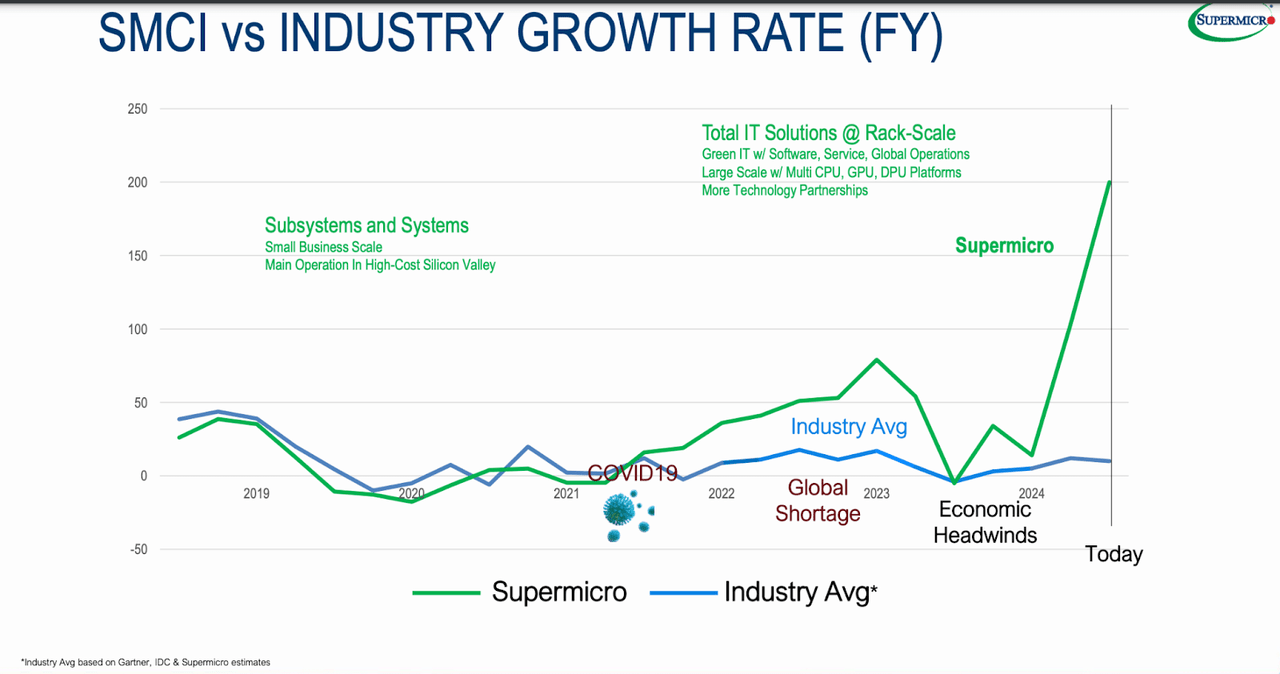

SMCI vs Indsutry (Investor slides)

Much like Nvidia, SMCI has that “it” factor that separates it from the competition, allowing it to massively outperform its peers. In the case of SMCI, the “it” factor is, of course, its superior liquid cooling solutions.

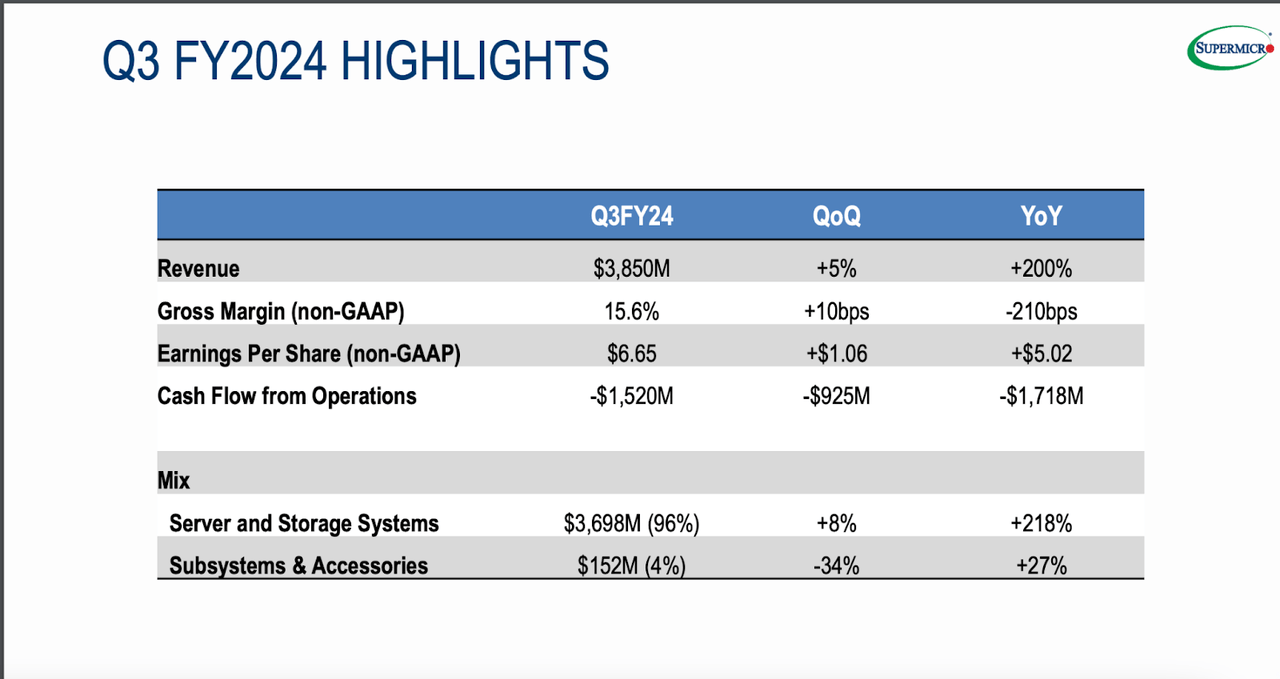

Q3 highlights (Investor slides)

The company’s revenues grew 200% YoY, though only 5% on a sequential basis. And although the margins were up QoQ, they were down YoY. It’s also worth noting that Cash flow from operations was a lot more negative in the last quarter too than in the previous.

According to the earnings call, the highly negative cash flow can be attributed to higher-than-normal inventory, which was up 67% due to the purchase of key components.

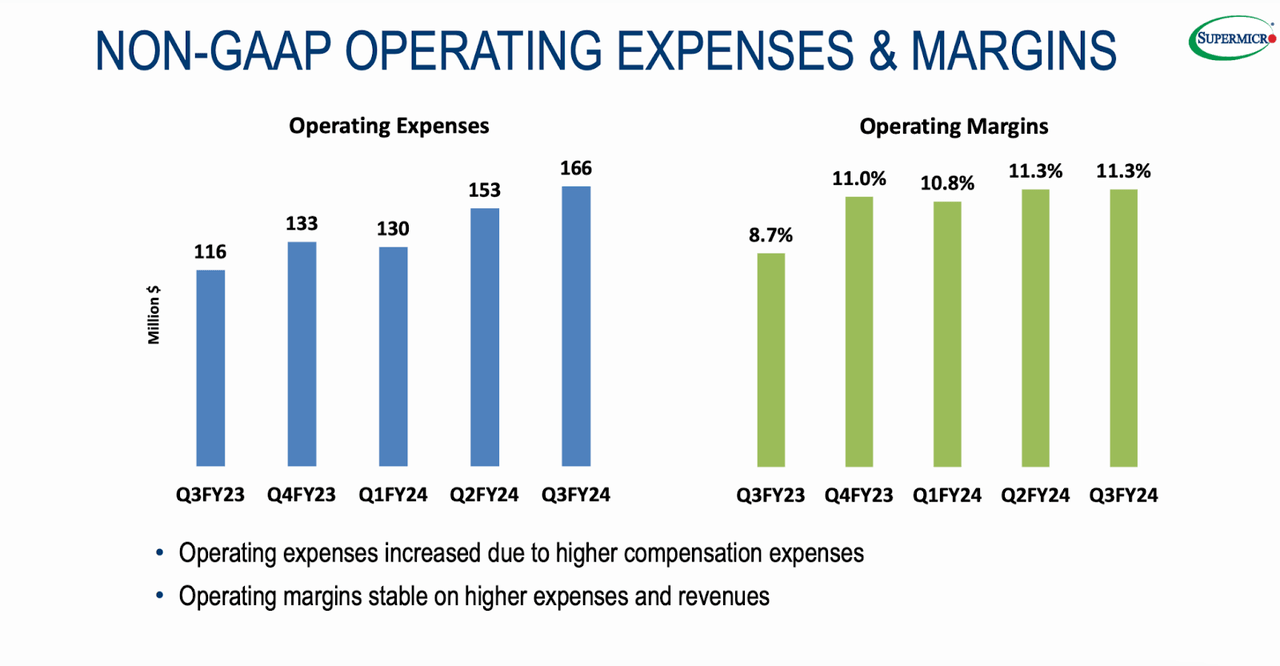

Operating expenses (Investor slides)

Looking at the actual operating margins, we have seen them stabilize at around 11%. The company’s compensation expenses have increased in line with revenues.

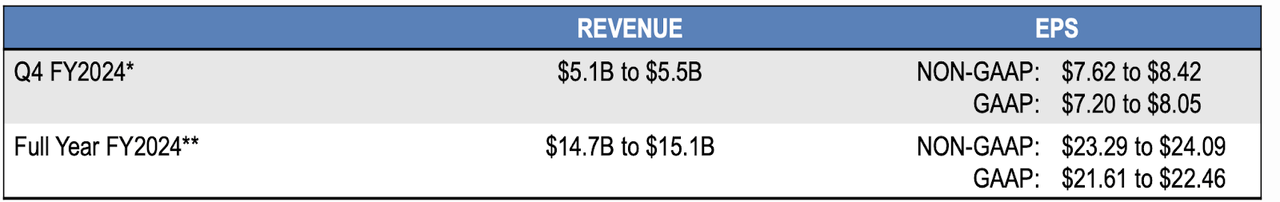

Guidance (Investor slides)

Lastly, looking at the guidance, SMCI is expecting up to $5.5 billion in revenues in Q4, and non-GAAP earnings of up to $8.42

That would be a sequential growth in revenues of over 40% on the high end. While earnings could increase over 26%.

Overall, the company’s guidance seems to suggest there’s still plenty of growth ahead, and that’s also supported by fundamentals, as we will discuss in the following section.

TAM and Future Outlook

The key to SMCI’s success is its liquid cooling technology. In the new world of advanced AI GPUs, liquid cooling is going to become the key technology needed to increase efficiency.

Yes. So, we have started to ship liquid cooling at really at scale, at larger volumes in this core. And so, there’s no question that that industry is coming up to speed with the reality of where we’re going, which is the fact that power is constrained all around the world.

Source: David Weigand, BofA Securities 2024 Global Technology Conference.

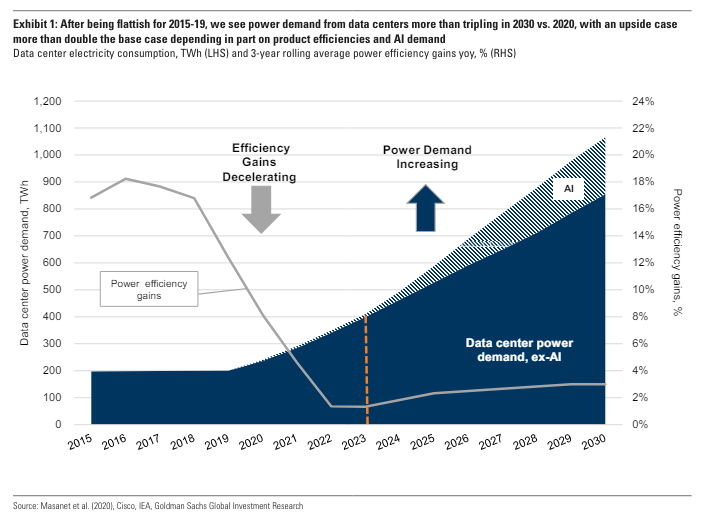

The last sentence is especially telling, and something which has been talked about before. The AI revolution will create a big surge in energy demand, and new estimates already reflect this.

AI energy demand (American Enterprise Institute)

In this regard, energy, not chips themselves, may become the true bottleneck in the AI revolution, and liquid cooling is currently the best way to fight this.

The CEO, Charles Liang, expects liquid cooling to reach a 30% adoption rate, which would be quite a big increase in demand.

Ultimately, SMCI looks like it is set to experience continued demand strength as long as the AI chop cycle continues its upwards trend.

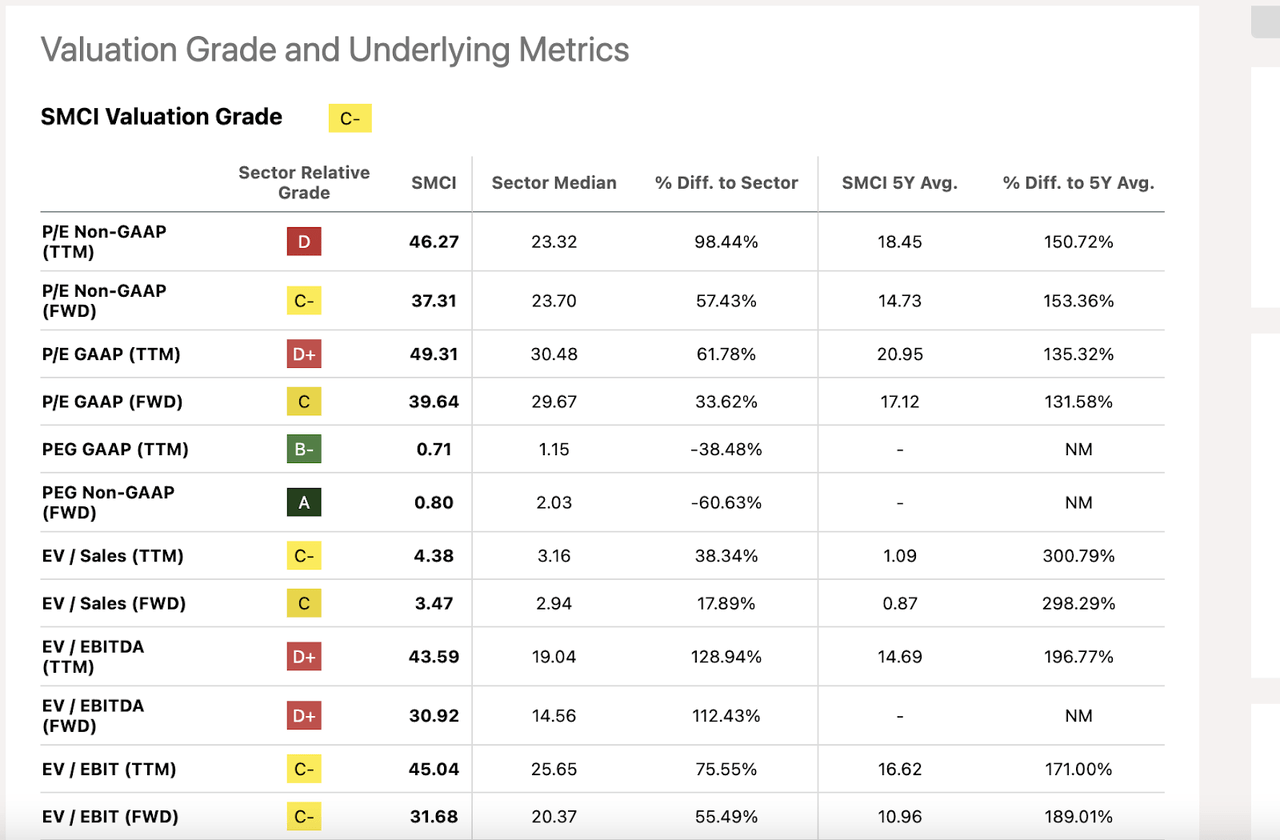

Valuation

And despite what you may think, SMCI is actually cheaply priced at this point.

SMCI Valuation (SA)

While the overall score on SA is a C-, the ratio I find most useful is the best price, and that is of course the PEG, and the forward PEG. In both cases, SMCI’s PEG is below 1, showing that it is below fair value.

This makes for a very compelling reason to buy, especially when we combine it with our TA analysis.

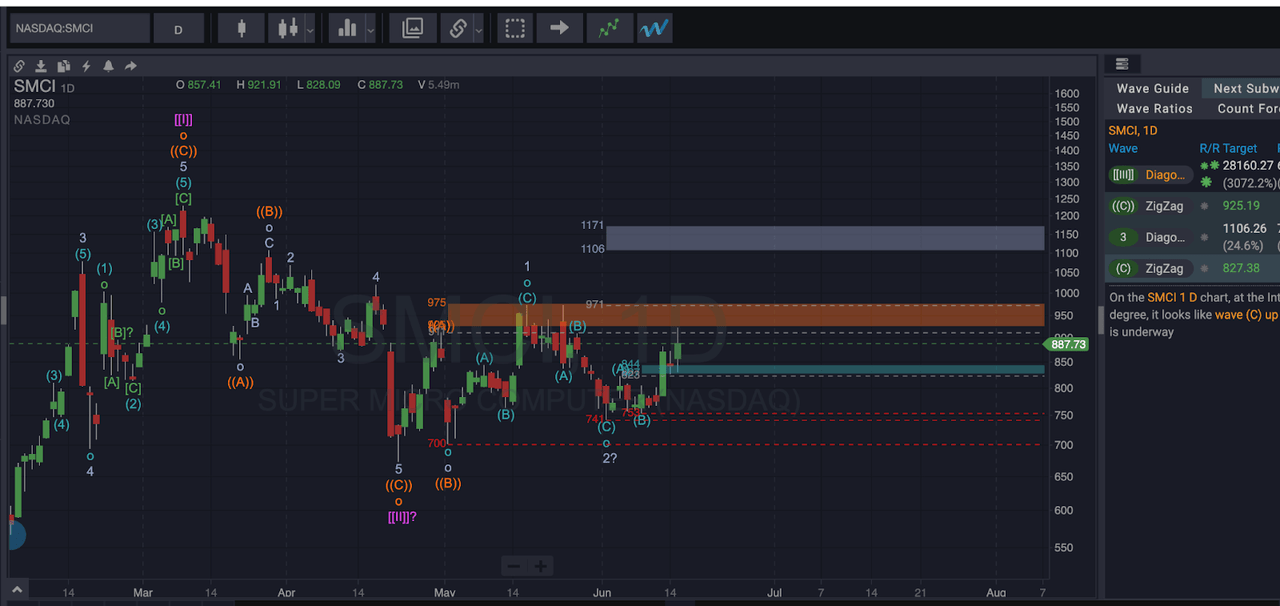

Technical Analysis

Looking at the technical outlook for SMCI, it seems pretty bullish by most accounts.

SMCI EW analysis (Wavebasis)

First off, we can see a pretty bullish set-up in terms of EW, with a potential 1-2 in place within a larger I-II structure. As long as we hold above the recent lows at $800, we should be good.

We have strong resistance at the orange line, with our first target to the upside coming in at 1106.

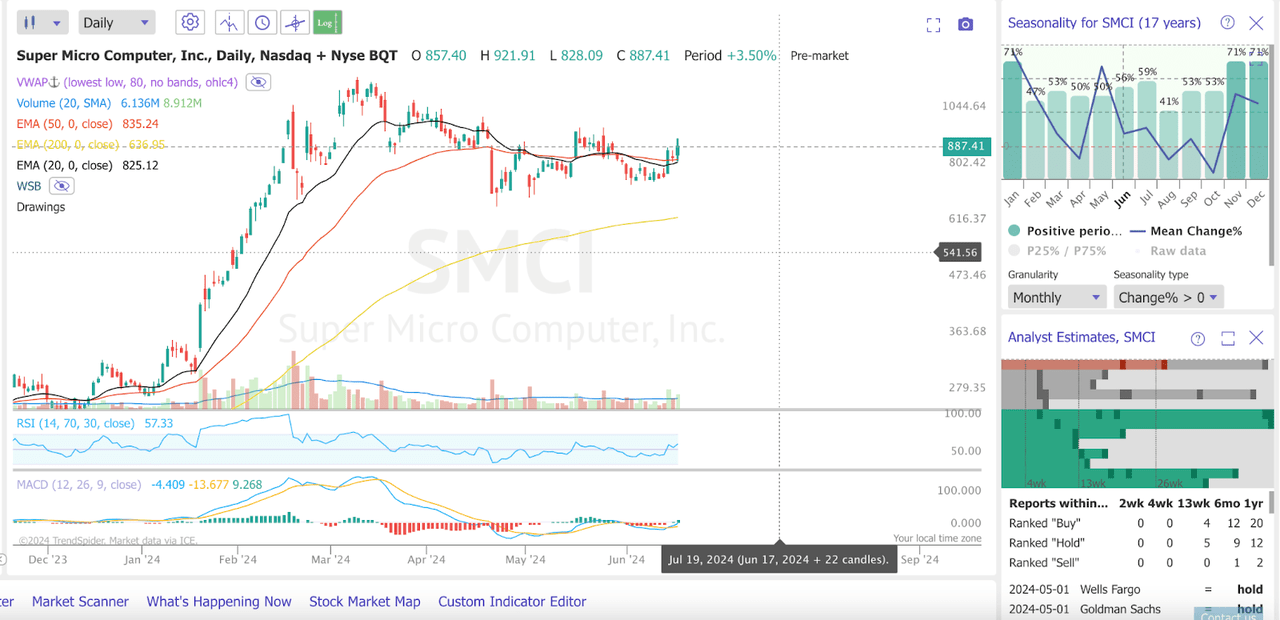

SMCI TA (Trendspider)

We have more bullish evidence if we look at this TrendSpider chart.

Firstly, note that the 20-day EMA looks set to cross back above the 50-day EMA. We’ve also had a bullish MACD crossover on the daily chart.

Looking at the panes on the right, seasonality favors further upside in June and July, with SMCI appreciating 56% and 59% of the time respectively over the last 17 years.

And, notice as well that analyst estimates overwhelmingly favor a buy rating, with 4 analysts upgrading their rating in the last 13 weeks.

Risks

There are still plenty of risks with SMCI. It’s possible that demands for Ai chips could cool off, which would certainly hamper the demand for liquid cooling. Furthermore, competition could begin to heat up as this technology becomes more prevalent.

Lastly, I am slightly concerned that operating cash flow was negative in the last quarter, though this should just be a temporary anomaly.

Takeaway

Super Micro Computer, Inc. stock looks like a solid buy at these levels. The stock is set to deliver another strong quarter, and the technical analysis supports further upside. We have formed a strong base, and should now rally to new highs.

Read the full article here