Dear fellow investors,

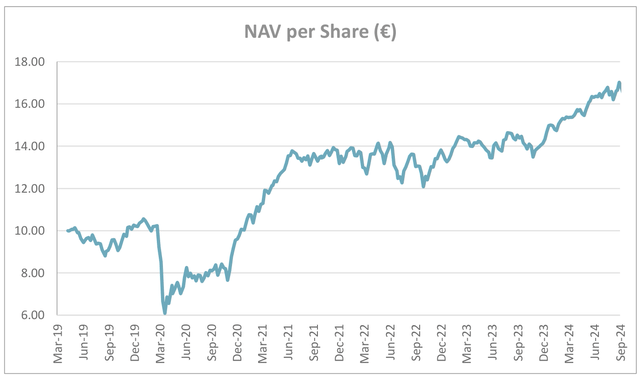

During the third quarter the fund gained +5.2% gross of fees 1. We do not have a stated benchmark in our Key Investor Information Document (KIID) and therefore cannot comment on relative performance. We leave it up to you to decide. We note the above number appears higher than European and global benchmarks. Our last reported NAV at quarter-end was 17.02 (26/09/2024), +4.4% from the closest reported NAV at the second quarter end of 16.3 (27/06/2024). This brings our year-to-date NAV return to +13.5% (28/12/2023 to 26/09/2024). Inception to quarter end NAV return was 70.2% or 10.2% compounded annual return. We are extremely optimistic about our portfolio’s prospects and believe we will reach our compound return aspiration over time. Our fund’s composition is unlike any index, and we are unlikely to perform in a similar manner.

The third quarter saw new highs for most major indexes but not without some volatility. There was panic as the yen carry trade unwound, when the Japanese central bank had the audacity to raise rates a tiny fraction for the first time in 17 years 2. The markets quickly panicked as levered speculators had to unwind risky trades quickly. The central bank quickly bowed to the pressure and put on a more dovish tone. The new prime minister Shigeru Ishiba also quickly came out with dovish comments as well. The market similarly egged the Fed on with market volatility and big scares about jobs (with the unemployment rate at what 4%??) in the weeks leading up to their meeting. It seemed well organized as CEOs in precarious business models and Wall Street strategist one by one made panicked calls. This allowed the Fed to give them what the speculators have been demanding for the past two years. We have said it before and will say it again, companies or “trades” requiring ultra-low interest rates to create value are not likely to be sound longer-term investments.

One actor that gets little attention is the Treasury. As interest payments on ever growing debt skyrockets, they are also feeling the pain 3. Unfortunately, the knee jerk reaction from politicians to both enormous debt and terrifying budget deficits seems to be higher spending and taxes. This is similar around the world. The UK, France and Italy are all considering various tax hikes and show no sign of budget constraint. But hey who cares as long as asset values keep hitting new highs right? Inflating away the debt will be our kids’ problem.

We had a decent quarter with several noteworthy developments within the portfolio. There were two takeover offers (unfortunately small ones in our tail) during the quarter, which contributed about 97 basis points of performance. Unieuro, the Italian electronics retailer had an offer from Fnac Darty (OTCPK:GRUPF), the French electronics retailer. We discuss the details and our view later in this letter. The second takeover was for Everi (EVRI), the slot machine manufacturer, which was to be merged with IGT’s gaming and digital divisions. For those of you who have followed our letters, you will know that IGT’s share price has suffered this year after it was announced that they would spin-off their gaming and digital divisions and merge them with Everi in a taxable spin. We purchased Everi as we thought it was a cheap way to add exposure to the deal on a post-spin basis.

The market had been hoping, as speculated in the press, that IGT’s gaming division would be sold to private equity providing a larger cash inflow to IGT, with less of a mess than a taxable spin-off. In fact, last year IGT was trading in the low $30s on this expectation4. Since then, the stock traded down to the low $20s. So, when Apollo finally did come through with a bid for both Everi and IGT’s gaming division, one would have expected IGT to re-rate. This has not happened – yet. We find it a bit perplexing, although there has been market commentary that IGT could lose the Italian lottery tender, so this could be the main reason the stock remains in the low $20s, despite the new deal structure. We find it odd, since it has been long known that there would be an Italian lottery tender, if anything there is less risk now than last year as at least one major potential competitor will not bid against them. What then has changed? Has the business experienced negative headwinds? No, it is doing fine. The only thing we can think of is that the new deal with Apollo may have re-set the timeline and we now have to wait a couple more quarters for the close. Patience is a virtue, and we believe IGT will re-rate substantially in the next 12 months, even in the unlikely case that the Italian contract is lost.

Another positive development in the quarter was with OCI (OTCPK:OCINF), the Dutch nitrogen fertilizer and methanol producer, which we introduced in our second quarter 2019 letter and further updated in our fourth quarter 2021 letter. During the quarter management announced the successful completion of the sale of the Iowa Fertilizer Company to Koch Ag & Energy Solutions for $3.6 billion, following regulatory approval. We believe this was the trickiest of their potential deals from a regulatory perspective, so its completion should alleviate regulatory risk. Furthermore, the company announced the disposal of its Global Methanol Business to Methanex (MEOH) for $2.05 billion, subject to regulatory approval and the resolution of a lawsuit from their joint venture partner in Natgasoline, Proman. Cumulatively, these divestitures, as well as the previously announced disposals of their stake in Fertiglobe, and their Texas blue ammonia plant are expected to crystalize $11.6 billion of gross value5. This will be used to reduce holding company debt and return capital to shareholders. The liquidation of the business is a likely scenario, since OCI will be left with only a European Nitrogen business and a stake in Methanex, although we can’t rule out other options. We expect a large tax-free dividend in the coming weeks.

Other positive developments include Ocean Wilson confirming it is in discussions to sell their stake in listed Wilson, Sons which should help unlock the holding discount. Dalata Hotel Group (OTCPK:DLTTF) and Syensqo (OTCPK:SHBBF) both initiated share buyback programs pointing out their depressed share prices. Moreover, Cellnex’s (OTCPK:CLNXF) Austrian tower disposal confirmed the massive discount of our publicly traded peer Eurotelesites and Jost, the commercial and agricultural vehicle supplier, announced a significant deal, although we are still awaiting all the details.

We sold three positions, including Everi, PAX and Unieuro during the quarter and purchased three new positions.

At quarter-end our portfolio had more than 97% upside to our estimated NAV and was trading at a weighted average P/E of 8.9x, FCF/EV yield of 17% and a return on tangible capital of 30%.

The top contributor during the quarter was Ginebra San Miguel (+23.6% +111 bps), the Filipino gin and spirits company which we introduced in our second quarter 2021 letter. Ginebra continued to report strong performance year-on-year in the second quarter with 12.5% volume growth and a 6% price increase which kept margins close to an all- time high. Cash generation followed suit, further boosting the company’s net cash position. Management hinted at improved shareholders returns with the potential to double the dividend payout ratio from 40% to 80%. The share price continued its upward trajectory following the solid earnings report but remains significantly undervalued.

As an update to our previous letter, we were able to finally procure a bottle of the classic Ginebra San Miguel gin (We also have a bottle of the GSM Mojito). We started with a blind taste test versus Hendricks and Tanqueray and surprisingly to us (because we are well trained to equate price with quality) all four of us had a preference for GSM over Tanqueray (albeit with Hendricks the clear winner). Our wine tasting friend had these comments: Hendricks: aromas of cucumber and bergamot, silky smooth. Ginebra San Miguel: aromas more on the mineral side, relatively smooth on the mouth but could use more botanic flavour. Tanqueray: light artificial citrus aroma, completely disjointed on the mouth with an overpowering alcohol burn. There you have it!

The second largest contributor was Ocean Wilson Holdings (+15.8% +78 bps), the Bermuda-based investment company with port and tugboat operations in Brazil, which we introduced in our third quarter 2023 letter. Wilson, Sons (PORT3), its majority owned listed subsidiary, performed well in the second quarter with sales increasing 16.9% to an all-time high. This was driven by its best-ever container terminal performance due to a new Asia- Brazil route that stops in Salvador and a new transshipment route to Argentina and Uruguay from the port of Rio Grande do Sul. Towage benefited from higher volumes and improved revenue mix. PORT3 is firing on all cylinders, and we think this might be one reason why its strategic review is still ongoing. That said, in late August, Ocean Wilsons confirmed discussions with I Squared Capital Advisers (US) LLC for the potential sale of its 57% stake in Wilsons Sons. Subsequently, in late September, PORT3 and its joint venture partner initiated a strategic review which may include the disposal of the joint venture interest. Of course, there can be no certainty of the outcome of these discussions, but we believe the strategic review that was launched in June of 2023 will likely conclude by year end. This should help close the significant discount to net assets for the holding company.

The third significant contributor was Ibstock (+23.1% +62 bps), the British brick and concrete product manufacturer, which we introduced in our third quarter 2019 letter. Ibstock reported first half performance in a challenging market with sales down 20% and EBITDA down 40% mainly due to lower volumes, reflecting lower demand and a disciplined approach on pricing in a very weak UK residential new build market The shares strengthened as Labour won the UK election with the new government’s commitment to increase the supply of new homes creating a more positive backdrop for medium term demand. The potential for new policy initiatives, coupled with the expectation of lower interest rates might indicate better days ahead for the industry. October’s budget announcement should provide more clarity on whether this optimism is well-founded or not. As for Ibstock, their major capital projects are close to completion so if there is an upswing in demand, the company should be in a position to generate substantial free cash flow.

The fourth largest contributor was Unieuro (+45.1% +54 bps), the Italian electronics retailer, which we introduced in our third quarter 2020 letter. In July 2024, Unieuro received on offer from the French retailer Fnac Darty for approximately €12 per share (consisting of €9 per share in cash plus 0.1 newly issued Fnac-Darty shares). There is nothing wrong with wanting to take advantage of a downcycle by offering an opportunistic price, however, the fact that this bid was not immediately unanimously rejected by the board is outrageous. Unieuro is a highly cash generative business with a cash rich balance sheet in a cyclical downturn. Post COVID demand normalization and low consumer confidence suppressed reported numbers in the past two years, but the company continued to generate cash. Throughout the cycle, we estimate that Unieuro can generate at least €30-40 million of annual free cash flow which on a conservative multiple gives significant upside from the bid price. It is worth noting that Unieuro has returned €7.5 of dividend per share since its initial public offering in April 2017 (and €5.5 since the fund invested), meaning almost 70% of its IPO price. We struggle to understand how such a lowball price could be considered “fair.” The board was split on its decision, with five members voting to approve and five against with one abstaining. We note that Iliad’s two directors voted in favor of the proposal, which we find odd given their average price is significantly above the bid price. We do appreciate the irony of a sell-side note, which recommended shareholders accept the offer, whilst simultaneously upgrading Fnac with more than 50% upside due to the pending upcycle in demand and the favorable Unieuro deal at the bottom of the cycle.

The fifth largest contributor was Kri Kri (+21.7%, +51 bps), the Greek yoghurt and ice cream manufacturer. We first purchased the shares as inflation battered their margins and they were unable to raise yoghurt prices in the short-term at their supermarket customers. This has now normalized with sales in the yogurt segment increasing 14.5% in the first half 2024 driven by a 19.7% increase in volumes. After substantial price increases, over the past year, management decided to give some back as cost inflation is fading. While pricing will normalize, the shift of consumers to private label yogurt remains intact and will support volumes. Sales in the ice-cream segment increased 21% over the same period, again driven mainly by volumes which were up 17% though prices also increased on the back of higher cocoa prices. All segments continue to report close to all-time high margins. The highlight of the quarter was the launch of frozen yogurt exports to the United States. Sales won’t be significant in the short term, but nevertheless the optionality remains very high with the press highlighting Wal-Mart and Kroger as potential customers. The founding family placed 3% of the shares at the end of the quarter to increase free float due to Athen Stock Exchange pending rules on free float. While a short-term negative, increased liquidity and market capitalization in addition to low valuation should continue to attract investors to the growth story.

The top detractor was Danieli Savers (-19.2%, -57 bps), the Italian steel plant maker and steel producer, which we introduced in our third quarter 2020 letter. At the end of the quarter, the company reported full year earnings with plant making revenues and EBITDA increasing 17% and 25% respectively on the back of strong backlog execution. Management sees steady volumes and good margins for the year ahead. However, steel making revenues and EBITDA were 13% and 56% lower than last year primarily due to lower prices and higher energy costs in Italy, which are higher than in other European countries. The 5% increase in volumes sold couldn’t compensate for these negative effects. Management targets volume increases by bringing both ABS Sisak in Croatia and ABS Spa to maximum capacity, which should improve margins in the year ahead. The share price reacted to an increase in Chinese exports6, which are set to reach an eight-year high in 2024. Falling domestic demand in China, which accounts for more than 50% of global production, means increased supply in Europe and thus pressure on prices. While cheap Chinese steel is a threat, we continue to believe that the European Union will protect a strategic industry by imposing steeper tariffs. Phased introduction of the Carbon Border Adjustment Mechanism, the mandatory levy on high carbon steel imported into the block, should offer some support to pricing as well. That said, we find the focus on their steel making division a distraction from their high-quality plant making division. This unit that has approximately two years of sales in the backlog as the global steel industry uses their technology to greenify steel. We think this is a multi-decade tailwind.

The second largest detractor was Verallia (-22.3%, -55 bps), a leading French glass packaging manufacturer, which we introduced in our second quarter 2022 letter. Following a couple of good years where Verallia reported strong pricing power and volume growth, the party came to an end at the end of 2023. We had reduced our position size during the boom, knowing a slowdown was imminent, but we were expecting a recovery and restocking in the second half of 2024. Verallia, however, announced a profit warning in early July and is now expecting flat growth. Second- quarter organic sales were down 10.4% mainly due to an industry wide destocking, which impacted volumes. Verallia over-indexes to spirits and wine with less beer exposure than peers. The product mix benefited Verallia in 2023, with beer being first to turn down. This is now in reverse with spirits taking longer to recover due to US destocking and a lack of growth in China. Selling prices continue to decrease across Europe compared to the peak reached in the first half 2023, albeit against a gradually recovering demand and sharply decreasing energy prices. Negative volume and price mix impacted EBITDA which reduced by 35% year-on-year. Management confirmed the initial phase of the recovery, but at a slower pace than expected and therefore adjusted the second half outlook accordingly. Through the cycle, we estimate that Verallia trades at a mid-teens free cash flow yield which gives us time to wait for a market recovery.

The third significant detractor was Var Energi (-13%, -32 bps), the Norwegian Oil and Gas operator. Var reported production of 293 kboepd 7 within their 280 to 300 kboepd guidance for the first half 2024. Furthermore, costs came below guidance at $12.2 per barrel. We think the new CEO Nick Walker, formerly of Lundin Energy, is doing a good job. But investors were clearly disappointed when their FPSO 8 for Balder X missed its sail-away window, meaning a delayed production from this significant field until the second quarter of 2025. The shares also suffered as Brent oil fell from $87 at the beginning of the third quarter 2024 to below $72 at the end. The commentary is around China demand collapsing and OPEC+ adding additional barrels starting in December. We tend to remain agnostic on macro trends in the very short term and use a long-term price of $65, which we think reflects the price needed to incentivize production. VAR over-indexes to natural gas, which is in short supply in Europe and has long-term growth prospects above the industry. We remain relaxed.

The fourth significant detractor was an undisclosed new position that we are still building (-13.6% -25 bps). The company is suffering due to its partial exposure to a cyclical end market. The market value is broadly covered by the value of its non-cyclical business. The cyclical part of the business is going through a turnaround with improving margins and we believe, with patience, substantial value will be created in the next upswing.

The fifth largest detractor was Pax Technology (-18.9%, -24 bps), the Chinese disrupter in global point of sale android devices. We exited Pax during the quarter. Despite building significant market share by outperforming incumbents Ingenico and Verifone in the past several years, the company recently stopped growing with what appears might be increased Chinese competition in the Andriod point of sale market. Further, working capital continued to deteriorate reaching 57% of sales in the first half 2024. The company has maintained excessive cash on its balance sheet and whilst it has increased its dividend, it has not materially made a dent in their cash pile. We are amazed at how accurately the company’s decision to build a new headquarter predicted peak margins. We must act quicker in the future.

M Dias Branco

M Dias Branco is the market leader in Brazil’s cookie & cracker and pasta markets with 31.8% and 28.9% volume share respectively and is more than 3.5x and 2x bigger than the number two player in the respective markets. The top five players control 58.2% and 65.5% of the cookies & crackers and pasta markets respectively, with the rest being smaller regional companies. M Dias generates approximately 52% of sales from cookies & crackers and 21% from pasta, with the remainder in wheat, margarine and vegetable shortening. With more than 20 brands in its portfolio, M Dias serves different customer profiles across different markets and product categories reaching 90% of Brazilian households according to Kantar. M Dias splits the business in Defense (North and Northeast) where they have 64% of their sales and market shares above 50% and Attack (South, Southeast. and Midwest), which constitute of 34% of sales and closer to 20% market share.

Manuel Dias Branco started baking bread in Fortaleza in 1936. M Dias Branco was formed in 1940 when Manuel formed a partnership with his brothers José and Orlando Since then, M Dias Branco is controlled by the family which today holds approximately 75% of the shares. Through a series of product innovation and acquisitions, the business generates more than R$ 10 billion in sales, owning four brands with over R$ 1 billion sales (Piraquê, Vitarella, Fortaleza and Richester) and is the number one player in both cookies & cracker and pasta categories in Brazil.

From 2015 to 2023 sales grew at 11.2% per annum driven by price increases and bolt on acquisitions. Over the same period, M Dias was averaging 38% gross margins and 15.6% EBITDA margins. On the cost side, M Dias operates 7 wheat mills which allows the business to better control costs compared to smaller players. So, we have a clear market leader in a growing consumer staple category with proven ability to increase prices generating mid-teens EBITDA margins mainly due to brand recognition, scale and some ability to control costs. The market valued the business north of 15x enterprise value to EBIT until 2022.

However, problems struck. First was COVID, followed quickly by rampant inflation. Historically, unfavorable movements in global wheat and palm oil prices were countered by favorable foreign exchange movements. During COVID years, 2020 and 2021, margins were hit by unfavorable mix of price and foreign exchange rates. 2022 was also challenged by extensive wheat price inflation due to the war in Ukraine. We believe these highly unusual movements will normalize with time. In fact, these trends did normalize in 2023. However, as the company is the market leader, they often lead on price increases and are somewhat slower to reduce prices. This has led to more volatile volumes compared to history given the extreme movements.

The crisis did not go to waste. In the meantime, management worked on improving operational efficiency on all fronts. They simplified SKUs (reduced by more than 300), focused on higher value-added products, set targets to grow domestically in the under- represented regions (Attack regions) and expand internationally either by increasing exports or entering new countries. New senior managers have been brought in from international food and beverage companies to professionalize the business, improve the supply chain and optimize working capital. Some of the changes are already noticeable with management negotiating credit terms with suppliers, increasing payables days from 18 in 2020 to 58 in 2023, resulting significant cash release for the business. In addition, they have reduced SG&A 9 costs as percentage of sales from 25.7% in 2019 to 20.5% in 2023. Other changes will take more time, based on discussions with industry experts. M Dias growth in the south is hindered by distribution challenges, which probably stems from the lack of production capacity in the region. The company is covering the demand from productions sites located in the north, which results in more late deliveries. While this has improved (the company points to ‘on time in full’ deliveries increasing from 41% in 2021 to 76% in 2023) there is still significant room for improvement. While the company has very strong own delivery in the north, they rely on wholesalers and distributors more in the south, which has lower profitability. They are increasing own delivery, owning new distribution channels and most likely will consolidate and relocate manufacturing facilities. All these initiatives could not only help margin recovery but should deliver further improvements in excess of historical levels.

Management is trying to tackle the increased penetration of the Cash & Carry channel in the Brazilian market. Cash & Carry mix for M Dias has increased from 16.2% in 2016 to 24.5% in 2023. The trend put pressure on margins, since Cash & Carry has significantly more bargaining power than small retail. To improve competitive positioning, management is working on developing the right products and packaging for Cash & Carry as well improve distribution to small retailers in the south.

The balancing act of price and volumes post inflation, the introduction of a complicated tax scheme and some ERP implementation challenges (We have never heard of an ERP implementation going according to plan) offered an interesting entry point for an otherwise good business. As cost pressure is cooling off on top of management’s initiatives to simplify the business, adjust prices and improve utilization, we expect to see EBITDA margins moving back to 15-16% range in line with history and likely above. In our view, M Dias trades at a mid to high-teens free cash flow yield, half the enterprise to EBIT multiple pre-crisis (7.5x vs 15x) and now has net cash on its balance sheet. We think the company will have room to continue to consolidate the market and increase the dividend substantially.

As stated in our previous letters, we are currently not charging a management fee until the fund reaches a larger size. The founder’s class management fee will then be only 1% of assets. We do not charge entry or exit commissions.

Our focus is and remains on the portfolio, but we do need to grow our assets to a sustainable level. Please feel free to share this letter with any potential investors.

We have a commercial agreement with Cobas Asset Management to distribute our fund in Spain. You can now open an account and place orders with them. For more information, please contact them via phone or email. In the future, we hope it will be possible via their website. You can reach the Cobas team at +34 91 755 68 00 [email protected]

Our fund can be invested in through both European international central securities depositories: Euroclear and its FundSettle clearing platform and Clearstream through the Vestima fund clearing platform. Our fund is registered for distribution in the UK, Spain and Luxembourg including for retail distribution.

Other distributors in Spain where our fund is offered include: Renta 4, Ironia, Lombard Odier, Creand as well as many other institutions working through the main platforms in which the fund is available upon request: Allfunds Bank and Inversis.

In the UK we are offered on the AJ Bell low-cost platform ajbell.co.uk and can be part of an ISA or pension.

Our fund is also available on Interactive Brokers interactivebrokers.com where you can open an account in almost any jurisdiction (fund not available in the US). SwissQuote swissquote.com also offers almost world-wide access where virtually any nationality (ex-USA) can open an account without local Swiss taxes being an issue.

If you have any issues finding our fund or wish to get more information about us and our process, please contact us [email protected]

Our fund is being offered as part of a Spanish pension value-orientated fund of funds. Please follow this link to find out more.

We thank you for your ongoing support. We continue to believe this is a great time to be a value investor and are very excited about the medium-term prospects for the current portfolio.

In other news, Konstantinos’ baby girl took her first steps, and Diana and Peter’s boys started Year 2 and Year 1 in September respectively. Diana also is hitting the books finishing a degree in art history and visual cultures.

Cheers!

Yours faithfully,

Palm Harbour Capital

|

Footnotes 1 Our NAV is calculated weekly by FundPartner Solutions, a subsidiary of Pictet & Cie and does not align with monthly or quarterly reporting. The gross return stated is net of taxes and fees but before fund expenses, which are currently running at approximately 15 bps per quarter at current AUM. We project this to decline significantly as AUM grows. Please see our comment on management fees. 2 Financial Times 3 Financial Times 4 Bloomberg 5 Financial Times 6 Financial Times 7 kboepd: thousand barrels of oil equivalent per day 8 FPSO: Floating Production Storage and Offloading 9 Sales, General and administration This information is being communicated by Palm Harbour Capital LLP which is authorized and regulated by the Financial Conduct Authority. This material is for information only and does not constitute an offer or recommendation to buy or sell any investment or subscribe to any investment management or advisory service. In relation to the United Kingdom, this information is only directed at, and may only be distributed to, persons who are “investment professionals” (being persons having professional experience in matters relating to investments) defined under Articles 19 & 49 of Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 & Articles 14 & 22 of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemption) Order 2001 and/or such other persons as are permitted to receive this document under The Financial Services and Markets Act 2000. Any investment, and investment activity or controlled activity, to which this information relates is available only to such persons and will be engaged in only with such persons. Persons that do not have professional experience should not rely or act upon this information unless they are persons to whom any of paragraphs (2)(a) to (d) of article 49 apply to whom distribution of this information may otherwise lawfully be made. With investment, your capital is at risk and the value of an investment and the income from it can go up as well as down, it may be affected by exchange rate variations, and you may not get back the amount invested. Past performance is not necessarily a guide to future performance and where past performance is quoted gross then investment management charges as well as transaction charges should be taken into consideration, as these will affect your returns. Any tax allowances or thresholds mentioned are based on personal circumstances and current legislation, which is subject to change. We do not represent that this information, including any third-party information, is accurate or complete and it should not be relied upon as such. Opinions expressed herein reflect the opinion of Palm Harbour Capital LLP and are subject to change without notice. No part of this document may be reproduced in any manner without the written permission of Palm Harbour Capital LLP; however, recipients may pass on this document but only to others falling within this category. This information should be read in conjunction with the relevant fund documentation which may include the fund’s prospectus, simplified prospectus or supplement documentation and if you are unsure if any of the products and portfolios featured are the right choice for you, please seek independent financial advice provided by regulated third parties. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here