MDT stock: Buy rating meets insider selling

The prevailing sentiment surrounding Medtronic plc (NYSE:MDT) stock is very bullish as you can see from the chart below. The chart shows that both Seeking Alpha writers and Wall Street analysts rate MDT as a buy. To wit, Wall Street analysts have a majority buy rating on MDT, with 11 analysts recommending a strong buy and 5 recommending a buy (out of 33 analysts in the last 90 days). Only 2 analysts recommend selling the stock. Seeking Alpha writers have an even more bearish sentiment on MDT. All of the 6 authors who rated the stock in the last 90 days recommended either buy or strong buy.

Seeking Alpha

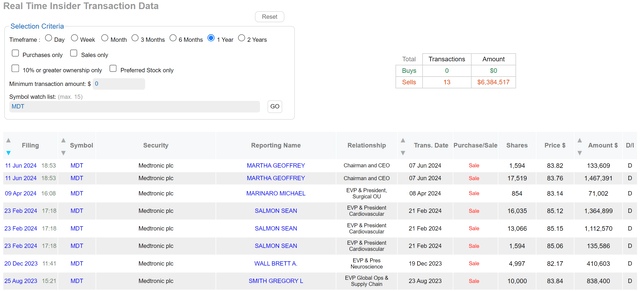

On the other hand, the insider activities surrounding the stock is completely dominated by selling. The next chart shows insider sales of their MDT shares over the past year. As seen, in total, 13 transactions were disclosed in this period and all of them are selling transactions. Notably, in the past few weeks in June 2024, Chairman and CEO Geoffrey Martha sold two batches for a price of $84. Usually, I don’t interpret insider sales as bearish signs for the following reasons detailed in my other articles:

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. Insider buying activities usually have only one explanation – the insiders think the stock is undervalued. In contrast, selling activities can be triggered by a range of factors irrelevant to business fundamentals. Insiders may sell a stock for a variety of reasons unrelated to the business, such as to diversify their portfolios, pay for a major expense, exercise stock options, or purely personal reasons (such as divorce or buying a new house).

However, in the case of MDT, I do see good reasons to pay attention given that 1) the insider transactions are completely one-sided and B) the growth and profitability and growth pressure that the business is facing now, as elaborated on in a later section.

Data Roma

MDT stock: the positives

Before I dive into the profitability and growth pressure, let me first address the positives. The stock certainly provides many good reasons to deserve the love from the bulls, especially dividend investors. MDT is a Dividend Aristocrat and I think it is also very likely to be crowned a dividend king in a few years. It has increased its annual dividend payout for the past 47 consecutive years (and the king status requires 50 years of consecutive increases), far exceeding the requirement for Dividend Aristocrat status (which is 25 years of increases). Such a strong record clearly demonstrates its stable moat and resilience.

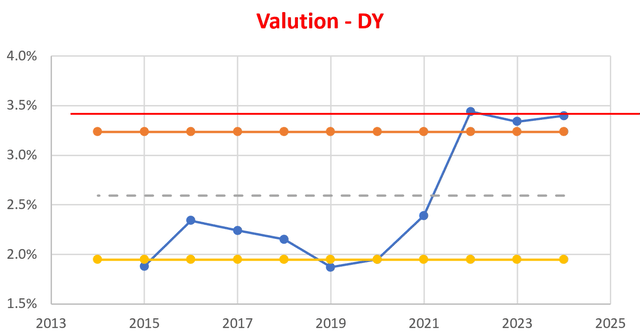

Furthermore, MDT is currently featuring a dividend yield far above its historical level as seen in the next chart below, a sign of attractive valuation. To wit, it is yielding 3.4% on an FWD basis (shown by the solid red line in the chart). To better contextualize things, its historical average yield in the past 10 years is about 2.55% (the dotted grey line). Its current yield is also above the 1+ standard deviation level (shown by the symbolized orange line).

Author

Looking ahead, I anticipate earnings to keep advancing at a stable pace in the low single digits (more on this in the next section). In particular, some of its product innovations have led to certain regulatory approvals. Notable examples include the Aurora system and the MiniMed Guardian among others. Product launches both at home and abroad ought to expand Medtronic’s addressable markets in traditional medical arenas such as cardiovascular, as well as newer fields, including neuromodulation.

However, I am seeing some profitability and growth pressure. As a result, the attractiveness of the valuation is not as great as it seems on the surface, as detailed next.

MDT stock: the negatives

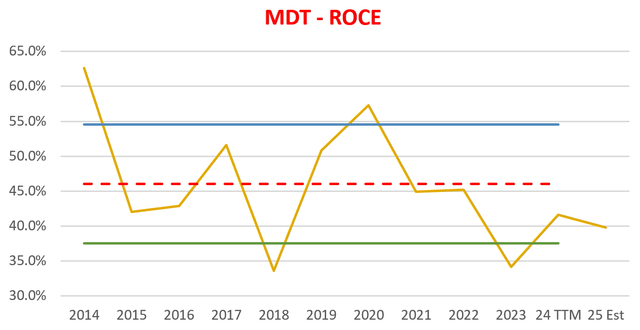

The next chart shows the return on capital employed (“ROCE”) for MDT in the past 10 years. In these analyses, I included the following items as its capital employed (which are different from its book value as detailed in my blog article entitled ROE Vs. ROCE With Q&A): receivables, payables, inventory, plants, property, equipment, and amortized R&D expenses. As seen, the business has been maintaining a robust ROCE with a long-term average of 46%. Currently, the profitability is towards the low end of the spectrum and my projection is about 39% for 2025.

Author

There are a few reasons for the profitability pressure. The top three in my mind are inflation pressure, pricing pressure, and also foreign exchange headwinds. Given the current macroeconomic conditions and CPI data, I do not see any of these going away anytime soon. Inflation has been causing high operation expenses in general (labor, fuel, etc.). In addition, the medical device industry is facing increasing pressure on prices from hospitals and other healthcare providers. With elevated inflation, I anticipate the pressure to intensify as healthcare providers and the government both try to control spending. Since Medtronic operates in many countries around the world, fluctuations in foreign exchange rates can have a large impact on its profitability. A strong dollar (which is the current condition) can make it more expensive to sell products overseas and reduce the value of profits earned in foreign currencies.

A lower ROCE translates into a lower growth rate in the long term. My method for analyzing long-term growth rates is detailed in my other articles. I will just present the final results when the method is applied to MDT:

The method involves the use of ROCE and the reinvestment rate (“RR”). My projected ROCE for MDT is around 39% as aforementioned. Its RR is about 7.6% on average. With these inputs, MDT’s long-term growth rate would be ~2.9% (39% ROCE x 7.6% RR = 2.9%). Note this number is the real growth rate without inflation. I assumed an average inflation of 2% and the notional growth rate would be 4.9% under this assumption.

With a 4.9% growth rate and 15.1x P/E at the stock price as of this writing, the stock is not as cheap as the dividend yield suggests. The PEG ratio (P/E growth ratio) is nearly 3x, far above the gold standard of 1x most GARP investors (growth at a reasonable price) look for. Dividend investors of course would argue that the PEG ratio is unfit here given MDT’s strong dividend record. It is absolutely true that if a stock pays a sizable dividend (like MDT does), investors do not need too much growth to earn a satisfactory return. So let’s try the PEGY ratio, which is the P/E ratio divided by the sum of growth rate and dividend yield. With an FWD yield of 3.4% and a growth rate of 4.9%, MDT’s PEGY ratio turns out to be over 1.8x, also far above the 1x gold standard most dividend growth investors look for.

Other risks and final thoughts

For the considerations analyzed above, I do not share the prevailing bullish sentiment surrounding MDT. I rate the stock as a hold under current conditions. As a leader in the stable medical device sector, MDT offers a reliable high dividend yield of 3.4%, attractive both in absolute and relative terms. The dividend aristocratic status adds further appeal for dividend investors. However, the high PEG ratio and PEGY ratio suggest the stock’s valuation is not as attractive as the dividend yield suggests on the surface. Inflation and pricing pressures could continue to dampen profitability and growth in the near term. Finally, compared to many of its peers, MDT has a heavy reliance on mature medical device markets, which tend to have slower growth and more intense competition. For these reasons, I think the recent insider sales do reflect business fundamentals and should be part of the decision of potential investors.

Read the full article here