Clear Secure (NYSE:YOU), the subscription service that allows for quicker security clearance in airports, has reported incredible operating leverage after my previous article as the company’s growth has continued into new airports and the company continues to attract new customers.

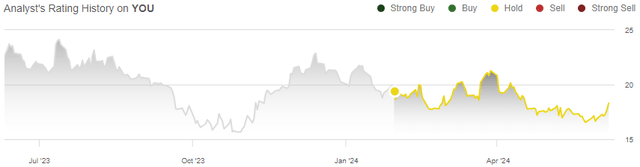

My previous article on the stock, published on the 30th of January with the title “Clear Secure: Great Earnings Potential, But A High Price”, initiated Clear Secure at a hold. In the article, I expressed the company’s great ability to grow revenues consistently, and that the growth has started to be leveraged into increasing income from a negative level with great cost management and operating leverage. Due to the high valuation, though, I didn’t see the stock as an attractive enough investment. Since the article, Clear Secure has returned a negative -5% compared to the S&P 500’s return of 9%.

My Rating History on YOU (Seeking Alpha)

Recent Quarters Show Impressive Operating Leverage

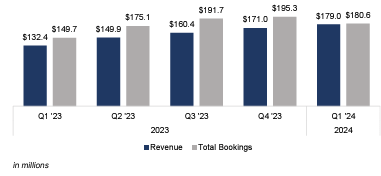

Clear Secure has reported Q4/2023 and Q1/2024 results after my previous article. Both quarters have shown steadily growing revenues with sequential increases of 6.6% and 4.7%, respectively, both implying good annual growth. The first quarter’s year-over-year revenue growth still reached 35.3%, but upcoming quarters are likely to show much worse growth percentage-wise as the comparison level steadily rises.

More importantly than the revenue growth, higher revenues have caused very impressive operating leverage. Operating expenses have stayed stable and even continued to decrease year-over-year in Q4 and Q1, leading to operating margins of 8.0% and 12.2% in the quarters, respectively – it seems that Clear Secure is now able to push growth through into earnings with a minimal need for reinvestments.

Both quarters have beat estimates, with Q4 beating revenue estimates by $4.3 million with a one-cent EPS beat and Q1 beating revenue estimates by $5.8 million along with an EPS of $0.2 beating estimates by $0.1 due to impressive operating leverage. At the time of my previous article, analysts estimated an EBIT margin of 5.1% for 2024, and I estimated that the margin estimate could have upside. Due to the recent performance, the estimate now stands at 10.5%. With Q1 showing an operating margin of 12.2% already, the current estimate could turn out to be conservative too.

For Q2, Clear Secure expects revenues of $182.5-184.5 million and bookings of $192-198 million, as told in the Q1 shareholder letter. The guidance shows slower expected revenue growth at a sequential growth of only 2.5% with the guidance’s middle point. The growth is still healthy and provides space for improved earnings, though.

For 2024, Clear Secure expects “to deliver strong revenue and Total Bookings growth, expanding margins and Free Cash Flow growth of at least 30% versus 2023”. In 2023, free cash flow ended at an already good $200 million, implying free cash flow of at least $260 million in 2024, making the cash flow yield nearly 10%.

Strong Balance Sheet Needs Better Use

Clear Secure currently has $64.1 million in cash and $634.3 million in short-term investments on the company’s balance sheet for a combined $698.5 million in capital that could mostly be distributed to shareholders or invested into growth, over a quarter of the company’s market capitalization.

The company has announced a share repurchase plan with an extension in March expanding the remaining share repurchase authorization to an estimated $141 million. Clear Secure has interest income of $32.5 million in the past twelve months, but in my opinion, shareholders should be let make their own decisions about capital allocation for the excess capital if more strategic opportunities don’t arise – I believe that another special dividend is due after Clear Secure already paid out a $0.55 special dividend in November 2023.

Investors Should Focus on Bookings

Behind revenues, bookings are the underlying driver of Clear Secure’s long-term growth. In Q1, bookings worryingly had a quarter-on-quarter decline of $14.7 million, and despite bookings often showing seasonal weakness in the first quarter, in prior years bookings have stayed quite flat from Q4 to Q1 making the decline alarming. A sequential improvement is guided for Q2, but I believe that a seasonal boost is a large factor in the improvement – investors should keep a very close eye on bookings in upcoming quarters.

Q1/2024 Shareholder Letter

A discrepancy between revenues and bookings has also caused impressive cash flows compared to earnings, and drives the incredibly high cash flows in 2023 and in the 2024 guidance. The discrepancy seems to be slowing down, though – although earnings should grow incredibly well, cash flows could be relatively stable in the future.

Clear Secure Needs to Sustain an Attractive Service Offering

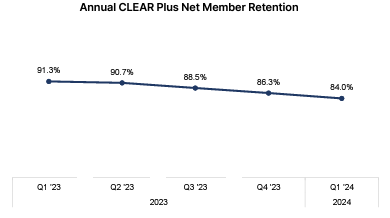

Underneath, Clear Secure’s subscription retention rate is worsening. The retention is still at a healthy annual rate of 84.0%, but continues declines are a very worrying sign and could drive bookings downwards if the trend continues.

Q1/2024 Shareholder Letter

To sustain bookings and renewals, the company needs to retain an attractive offering. A bill has been introduced in California by Senator Josh Newman trying to require Clear Secure to have separate security areas in Californian airports instead of using the same area as non-members. The bill potentially threatens the service in the state with more complications, and it seems that Clear Secure’s offering is under pressure as I already previously wrote about TSA’s concerns with the service.

Slight Undervaluation Is Justified by Risks

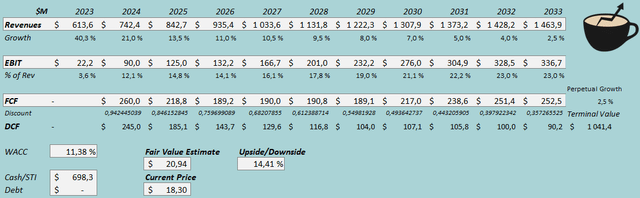

I updated my DCF model from previous estimates. After the Q2 guidance shows slower revenue growth and bookings have slowed down, I now estimate slower revenue growth than previously at 21% in 2024 compared to 28% previously. Afterwards, I also estimate more conservative growth with revenues ending up at $1428 million compared to $1656 million previously. The new revenue estimates represent a CAGR of 9.1% from 2023 to 2033.

Due to very great margin expansion, I estimate margins more optimistically than previously, ending the EBIT margin at an eventual level of 23% compared to 20% previously.

Cash flows seem to be higher than I anticipated, too, and I estimate great but quite stable cash flows going forward. As bookings slow down, the revenue and earnings growth don’t look to contribute too much into free cash flow growth especially in upcoming years in my opinion.

DCF Model (Author’s Calculation)

The estimates put Clear Secure’s fair value estimate at $20.94, 14% above the stock price at the time of writing and 6% above my previous estimate of $19.73. The undervaluation doesn’t really provide an attractive entry point in my opinion, though – the mentioned booking and regulatory risks make the slight undervaluation justified.

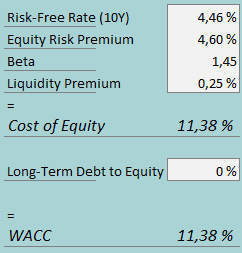

A weighted average cost of capital of 11.38% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

I continue to estimate no debt for Clear Secure due to the strong balance sheet. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.46% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Seeking Alpha now estimates Clear Secure’s beta at 1.45. Finally, I add a liquidity premium of 0.25%, creating a cost of equity and WACC of 11.38%, nearly the same as before.

Takeaway

Clear Secure has continued to grow revenues mostly as expected and has proven to be able to generate aggressively increasing margins through operating leverage. Free cash flow is guided to be higher than I previously anticipated, but I don’t estimate future earnings growth to contribute too well into increasing cash flows in coming years. The growth case is also posed with risks – bookings in Q1 performed poorly, and the member retention rate is continuously declining. In addition, potential regulatory risks pose a risk with a current introduced bill in California. The stock now has moderate undervaluation if the growth continues as expected, but as the investment is riddled by some potential risks, I see the valuation as a balanced assessment of Clear Secure’s value. As such, I remain with a Hold rating.

Read the full article here