People love bitcoin…or they really dislike it. Few are in between. I am one of the in-betweens. While I see massive potential in the blockchain, as many investors do, I still fail to see cryptocurrencies as a long-term buy and hold asset. That doesn’t mean bitcoin won’t skyrocket in price at some point, and I would not be the least bit shocked to see it plunge to and through its depths of the past several years.

So, I am indifferent on the aspects of bitcoin that so many investors debate endlessly. I just like finding ways to make money over multiple time frames. I chart 12 different time frames for many stocks and ETFs. And the range of ETFs I track is only limited by what 3,400+ such listed securities allow me to own. Or, rent, as is the case with anything crypto-related.

I am an ardent risk manager, a conservative investor to the core. My number one investing rule is ABL: Avoid Big Loss. And so when first bitcoin proxies like BITO, and then spot bitcoin ETFs hit the market over the past several years, I was happy to check them out and figure out if and how they fit into my overall approach. And since BITO also has a fairly active, though not very tight (spreads) options market, I have dabbled there as well.

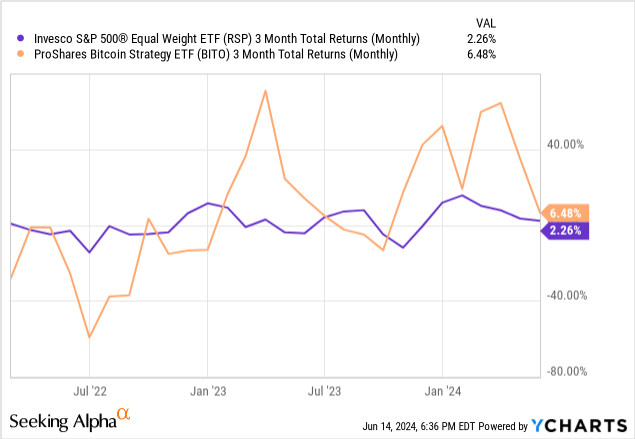

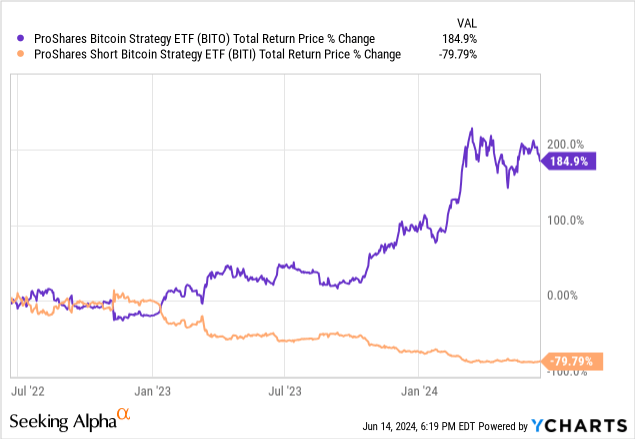

But the other thing BITO has, as many macro-style investments I track do, is an inverse “cousin.” BITO aims to track bitcoin moves. And BITI aims to track the opposite of what BITO does. And frankly, the ability to play offense or defense as I wish when it comes to this specific asset class makes me very happy that bitcoin exists. The type of volatility relative to the stock market exhibited by BITO and its peers versus, say, the average S&P 500 stock (RSP) makes BITO and BITI very “useable” tools to me.

BITO and BITI: opposites attract me

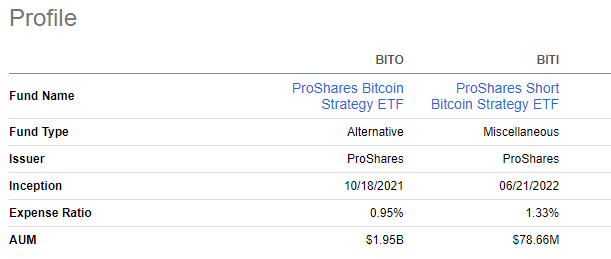

One thing I like about these “pairs” of long and inverse ETFs is that I can see the relative asset bases, and it adds another element to my sentiment analysis. Simply put, BITO’s assets under management dwarf those of BITI. It is 24 times the size! Or put another way, if this were an election between 2 candidates with opposite platforms, BITO would be getting 96% of the vote. The contrarian in me sees this, as I have with other asset classes in the past (TLT and TBF for long US Treasuries, QQQ and PSQ for the Nasdaq 100, etc.) and thinks, “There’s an opportunity to potentially profit at some point in time by going against the crowd.”

Seeking Alpha

BITO’s dividend yield: don’t believe it!

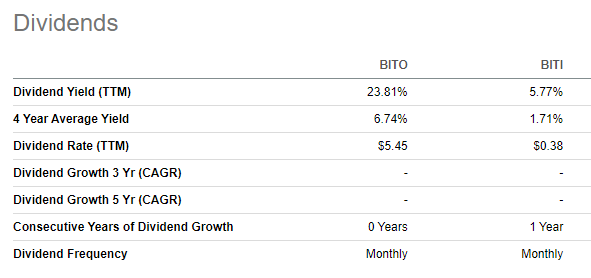

I was surprised when I first saw that BITO and BITI pay a dividend. Dividend on what? Bitcoin doesn’t have a yield. This is a great example of when it comes to dividend information on ETFs, don’t believe everything you read!

Technically, it is a dividend, but is really just the mandated distribution of profits on the underlying futures contracts that power much of BITO’s assets. Those contracts don’t last forever, and when they expire, there is a settling up process. And so the profits are distributed to shareholders as dividends.

Seeking Alpha

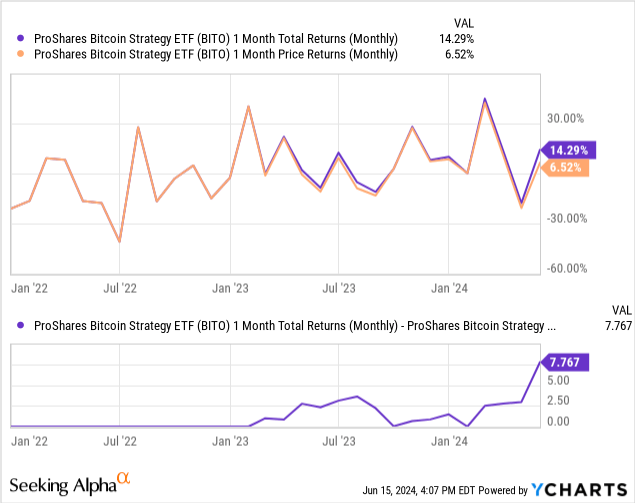

So, a higher dividend yield on BITO and BITI (which works the same way) is that the more bitcoin goes up, the more BITO’s dividend will be. I show the difference here, with the bottom of the chart showing the amount of BITO’s gain that was technically a dividend distribution. Note that the dividend was zero for the ETF’s first year, since there were no contracts settling and/or the price of BITO did not go up.

How I fit bitcoin ETFs into my overall investment process

To be clear, while I don’t buy and hold bitcoin-related securities, I track them continuously, but with a focus on price, since I am a technician primarily. As I’ve written here many times, my security selection process starts with scouring ETFs and stocks for the fundamental and quantitative characteristics I like. That leads to a watchlist of names I am willing to own “at a price” which includes inverse ETFs. From there, the ongoing “blocking and tackling” effort takes over, and I am willing to hold something for years. But much more likely, I will own it (or perhaps better stated, “rent” it) several times over the course of a few years. That is NOT speculation or day-trading. It is my proprietary process of risk management. And it worked well for me for 27 years, managing other people’s money, building a firm around that process, and selling it to semi-retire at age 56.

None of this is intended to be a “brag.” I’ve made about every dumb move an investor can make…but always learn from it. And so when a new asset comes along, and the investment world is split on whether it is digital nirvana or an elaborate scam, I ignore both sides of the argument. All I care about it making money during the time I own something, and not losing big. No “style points” here.

Now, to the charts!

BITO is one of many ways to use bitcoin in my portfolio. But to consider it more than something to rotate in and out of takes more risk tolerance than I want to have. Oh, I will dance around BITO with very small put option and call option positions, but those might account for maybe 1/10 of 1% of my wealth. If the option went to zero, it would be like losing 1% on a 10% position in, say, an S&P 500 ETF. This is something I think too few investors think about. Position sizing.

So when I see BITO with a habit of swinging 50% in either direction in a 3-month period, versus the average S&P 500 stock (RSP) fluctuating a fraction of that during the same set of 3-month time frames, I have to position size BITO and BITI (its inverse ETF) much, much lower.

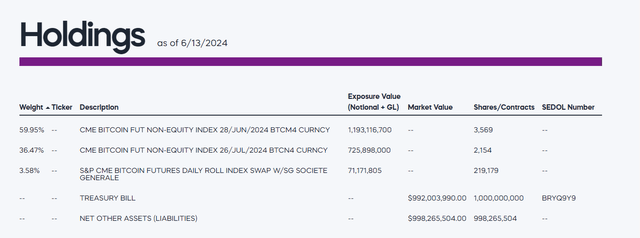

BITO is not my ideal ETF when it comes to how it gets at tracking the price of bitcoin. But beggars can’t be choosy, and this is a listed fund investing in an asset that isn’t a business, can’t be touched with our hands and which has attracted all types of players, from uber-wealthy professional investors to 2-bit scam artists. So to me, it is another reason to keep position sizes low.

I know the swaps and futures industry fairly well as a former Wall Street broker and investment advisor who started in New York City back in the 1980s. And they have come a long way, and I realize they are necessary to create many of these vehicles so we can try to make money with them. But I tend to focus more of my attention on stocks of companies, and options on long-established indexes and ETFs. And I prefer this to a structure like that of JEPI, where the exact contracts used to provide covered call income are not fully disclosed. I prefer, and in most cases insist, on knowing exactly what I own. That’s the whole advantage of ETFs in the first place.

ProShares.com

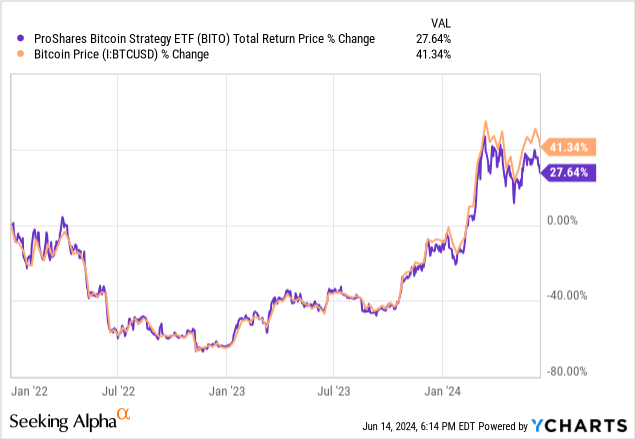

BITO versus Bitcoin price

BITO did a fine job of tracking bitcoin before spot bitcoin ETFs came along. In fact, when the first 12 of those spot ETFs debuted back on January 9 of this year, I was like “OK, whatever.” I have used iShares Bitcoin Trust ETF (IBIT), but BITO remains on my watchlist in large part because I can use it in rotation with BITI when bitcoin gets very “whippy” in its price action, and it has options listed on it, which the spot ETFs do not at this point.

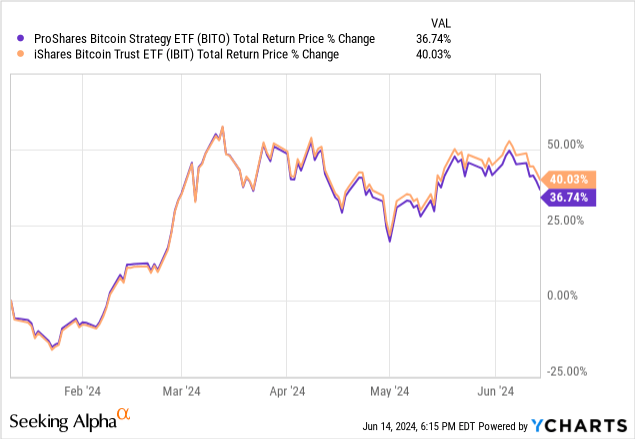

Since IBIT debuted more than 5 months ago, BITO has trailed a bit, but not enough for me to take it off of my watchlist, for the reasons cited above. IBIT is also on my list, and I have bought and sold it twice this year.

BITO: Technical charts – this is where it gets interesting

For those who think of technical analysis as voodoo, as many did for decades after my late father (a self-directed investor) taught me starting back in 1980 (with pencil and graph paper!), what I’ve written so far was the technical “background” I try to do with every security before it makes my watchlist. I need a fundamental understanding of what something is, and before I chart it for decision-making, I do the type of quantitative assessment of correlation, price pattern, volatility, and evaluating the alternatives.

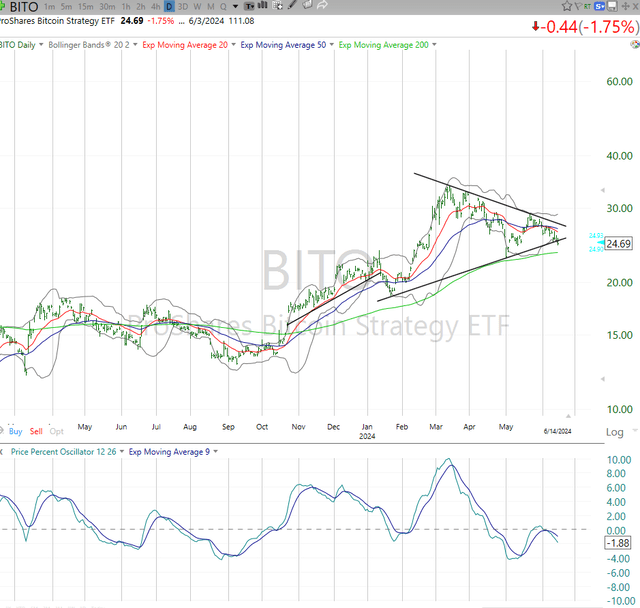

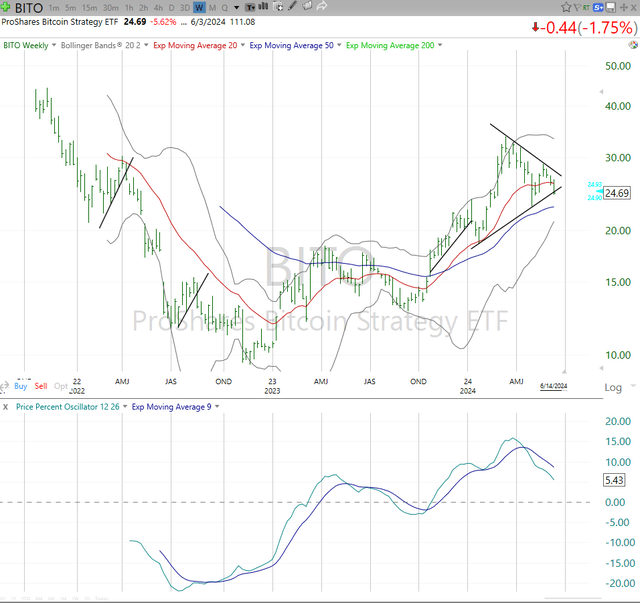

Now, it is time to get to the good part: am I going to rent BITO, or do something else? This daily price chart has a very strong pattern. Some call it a triangle or a wedge, but I try to minimize the lingo and just say what I see. I see a pattern I’ve seen thousands of times with many securities and asset classes. It tells me that the chances are strong that BITO is going to move sharply in one direction or the other.

TC2000 (SunngardenInvestment.com)

Before you say “duh, of course,” see how its volatility has been declining for months, and it is now reaching a point so narrow, it is bound to get more volatile soon. In which direction? Most likely in the direction it is currently going.

I initiated a position in BITI recently (small, of course) because I saw the price of BITO break down through that lower line, albeit just slightly. But the indicator on the bottom, my favorite momentum indicator, also cross below 0.00, which means falling upward momentum. Put those 2 pieces of evidence together, and I saw a modest-risk situation to try to profit from BITI (lower bitcoin price), maybe for weeks or months, or maybe longer. I won’t know until the chart tells me more. That’s how I do things. But with bitcoin, I have seen it to be far less reliable in chart form, so I tread lightly, and don’t try to overthink it.

Below is a weekly price chart, and it looks a lot like the daily chart above. That doesn’t always happen, and that it is the case here increases my chances of being able to hold BITI longer and make a bigger profit. I also will be considering increasing the position, if (big “if” with crypto assets) I can make a decent unrealized gain to start. That gives me the financial “permission” to try to take some of that profit and put it at risk by owning more shares of, in this case, BITI. But I’m not there yet.

TC2000 (SunngardenInvestment.com)

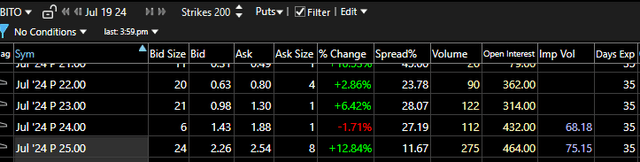

Here’s a snapshot of the BITO put options market as of last Friday. Those are some big spreads, but I’m ok navigating that with, as noted earlier, a small position. I own a tiny amount of those July 19 expiration, $22.00 puts. Sometimes, I do this simply to have it on my screen in case it gets more interesting. I prefer not to “paper invest” because it just isn’t the same as having some capital at risk, even if it is something akin to a nice steak dinner for 2–4 people.

TC2000

I’ve owned BITO, but currently I own BITI. Here’s why.

I guess I could just say the charts told me so. And if the BITO chart looks good enough to try to make money on from its decline in price, that means BITI is a buy, at least tactically, and in small size to start. Here is the BITI chart. I’d call this early stage, but that 20-day moving average turning slightly up is my cue to take a shot at this early on.

As we can see, it is coming off a fake breakout that did not last long in April. But to be clear, that fake out could have produced a buy of around $8.20 which sprinted up 10% to over $9 a share in just about 2 weeks. Again, this article is NOT about trading bitcoin ETFs. It is about reward and risk over different time frames, and how I apply this approach to everything I consider and own. So with perfect hindsight here, if I were up 10% in 2 weeks, I’d already be thinking about de-risking a bit because as I say all the time in my articles for Seeking Alpha, these markets are not like they used to be.

Until a true up market that is more inclusive and less gyrating comes along, it is more likely one makes 10% in a short amount of time than makes 20% over a year or two. That’s my strong belief.

TC2000 (SunngardenInvestment.com)

One knock on inverse ETFs, whether they be single inverse like BITI is to BITO or something derived from stock or bond market assets, is that the math works against you if you hold them too long. My response: don’t hold them too long! With any pair like this, I expect that over time, the amount of weeks/months I will hold BITO will dwarf that of BITI. Inverse ETFs fade sharply if the asset goes up at a fast pace and/or over time. This is a basic element of “playing offense and defense at the same time” that every investor should learn if they want to invest this way. I’ve been investing in inverse ETFs since they first came onto the scene, so I have seen this in play for a long time.

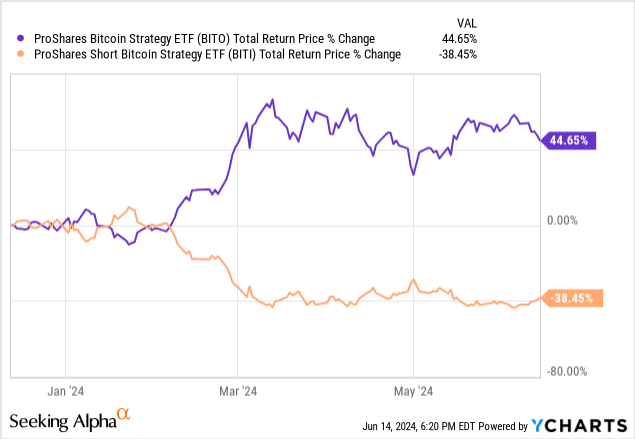

At the same time, the basic role of inverse ETFs is under-appreciated by investors. The goal is not a perfect inverse. It is to have a way to profit from declines in an asset. And as shown here, if you owned equal parts BITO and BITI (“arbitrage”) so far in 2024, you actually made money on the “spread” between them. I am not telling anyone to do it, just pointing out that inverse ETFs are not as bottom-line as many views them. I see many uses for them in my own work.

Conclusion: I own BITI, but I am always looking to own BITO

I’ve covered a lot here. And this article was part BITO and part using BITO as an example of how long and inverse ETFs can be used together, though not necessarily at the same time. As I see it, why settle for only trying to increase my liquid net worth on one side of the market? Every asset class goes up and down, sometimes for months, quarters and years at a time. Since the late 1990s, well before it was fashionable outside of hedge funds, this type of modernized “long-short” investment approach has served me well, first as a manager of other families’ money, and now for my own.

I’m holding BITI shares and BITO put contracts in small size now, but if that potential breakdown I see in the daily and weekly charts as noted above go from a hint of a big move south to much more than that, I am open to increasing my stake.

Read the full article here