Stay informed with free updates

Simply sign up to the Equities myFT Digest — delivered directly to your inbox.

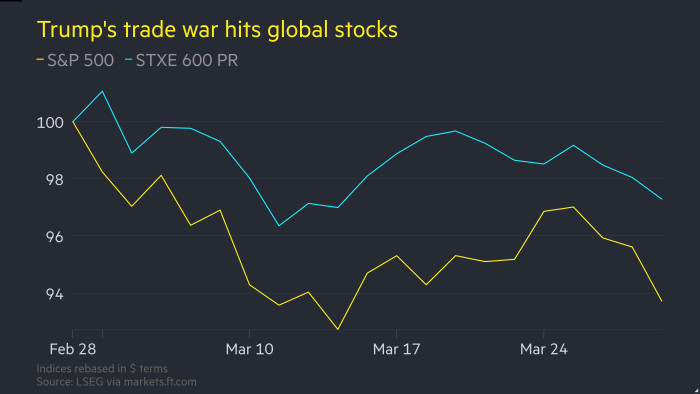

Global markets tumbled on Monday, with US stocks set to close out their worst quarter since 2022, on fears of an escalating trade war led by President Donald Trump.

European and Asian stocks fell sharply and US futures were lower ahead of the New York open, accelerating a sell-off that began last week, after Trump said the reciprocal trade duties he is expected to announce on April 2 would apply globally.

Europe’s broad-based Stoxx 600 index dropped 1.7 per cent, while the FTSE 100 lost 1.3 per cent. The Nasdaq 100 was poised to open 1.4 per cent lower and the S&P 500 down 1 per cent.

“We’re seeing another wave of US-led selling,” said Trevor Greetham, head of multi-asset at Royal London Asset Management. “There’s been no let-up from Trump.”

Consumer-facing companies and other economically sensitive stocks fared the worst, with International Airlines Group down 6 per cent and tourism group Tui down 5 per cent, amid concerns over demand for flights.

“I don’t necessarily see the floor quite yet,” said Sharon Bell, senior equities strategist at Goldman Sachs.

Gold surged as high as $3,128 a troy ounce, a record, while US Treasury yields declined, in a sign that investors were piling into safe assets. The 10-year yield, which moves inversely to prices, fell 0.07 percentage points to 4.19 per cent.

The latest moves came after Trump addressed reporters on Air Force One on Sunday, saying on tariffs: “You’d start with all countries, so let’s see what happens.” Last week he had hinted at concessions for some countries.

The US president singled out Asia for its trade practices. “Take a look at trade with Asia. I wouldn’t say anybody has treated us fairly,” he said.

The chaotic rollout of Trump’s aggressive trade agenda has roiled markets and alarmed the US’s trading partners, many of whom have threatened to retaliate.

The US president has said that on Wednesday, which he has dubbed “liberation day”, he will impose levies on any country the White House deems to have an unfair trading relationship with the US.

Charles De Boissezon, global head of equity strategy at Société Générale, said cyclical stocks, whose performance tended to fluctuate with the economy, were suffering. “It is much more the uncertainty overall weighing on investor sentiment,” he said. “The [tariff] announcements keep on changing, but what they have in common is that [they’re] just not good for growth globally.”

Monday’s market moves came after falls on Friday in the US, when the S&P 500 dropped nearly 2 per cent. The tech-focused Nasdaq Composite slid 2.7 per cent as gloomy data on the economy and consumer sentiment raised fears about stagflation. The S&P 500 index is down more than 5 per cent so far this year.

In Asia on Monday, Japan’s benchmark Topix dropped 3.6 per cent and the exporter-oriented Nikkei 225 slid 4.1 per cent. South Korea’s Kospi fell 3 per cent, while Hong Kong’s Hang Seng retreated 1.3 per cent.

“Many investors are [waiting] for actual tariffs to be announced, unwinding their positions and realising gains,” said Wei Li, head of multi-asset investments for BNP Paribas in China. “This tariff announcement . . . has affected the whole market sentiment.”

The dollar was flat against a basket of its major trading partners. Having strengthened after Trump’s election on the anticipation of tariffs feeding inflation, the greenback has weakened this year as investors grow more concerned about the impact of the trade war on the US economy.

Read the full article here