Dear Investors,

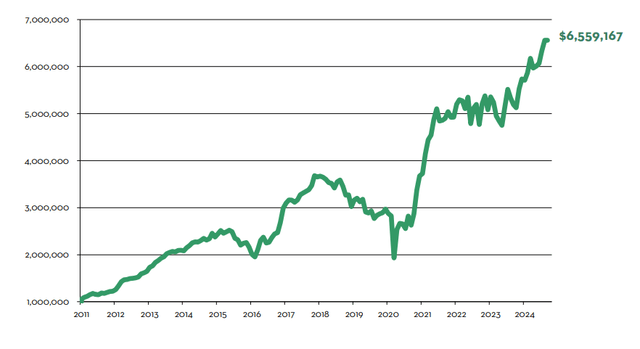

The Portfolio* appreciated +14.3% (net of fees) year-to-date through 9/30/2024.

Since inception, Marram has generated +555.9% cumulative return and +14.7% annualized return, net of fees.

For monthly details, see Historical Performance Returns* at the end of this letter. Also, please refer to your separate account statement for exact account return figures.

$1,000,000 Investment in Marram (Net Return, Inception 1/1/2011 to 9/30/2024)*

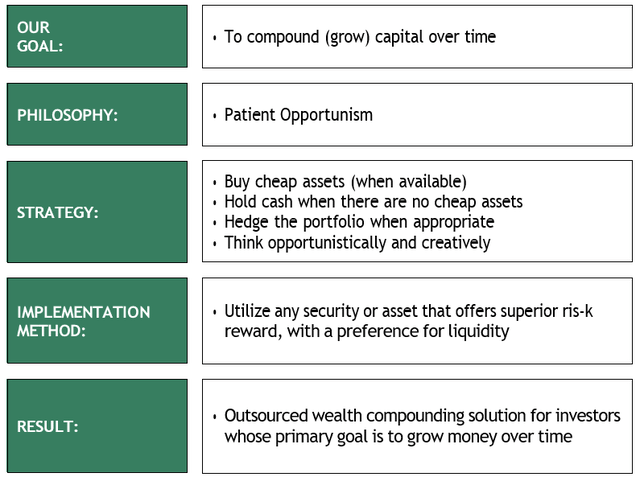

About Marram

Marram is an outsourced long-term investment solution, focused on growing wealth for retirement or legacy purposes. We began as a service for a small circle of friends and family. Our investor-friendly fee structure (lower than hedge funds), terms (separate accounts, no lock-up), and high standards of care and excellence, reflect those origins. Our portfolio manager has the majority of her family’s liquid net worth invested in the same strategy – we eat our own cooking – ensuring that we shepherd your investment with the utmost care, as we would our own.

Portfolio Allocations

Below is the target portfolio allocation – the optimal allocation as of the writing of this letter. Investor separate accounts may differ from this allocation due to changes in asset prices, availability to acquire/divest securities in the marketplace, margin & trading capabilities, and tax considerations.

Over time, all investor separate accounts converge upon the target portfolio allocation.

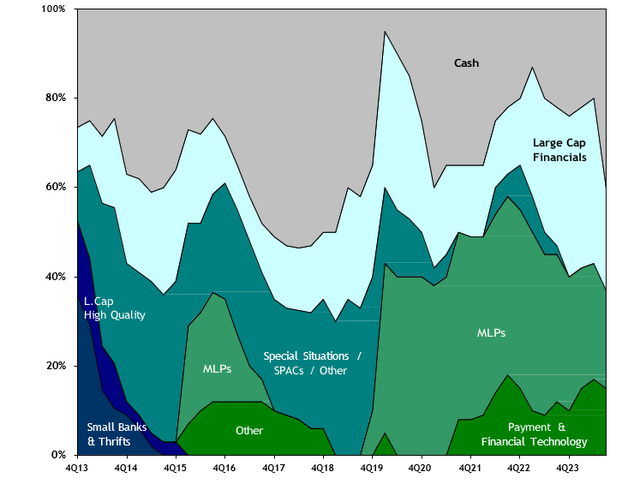

Large-Cap Financials: 23% NAV

In March 2023, the U.S. banking system experienced a brief crisis when three banks failed in quick succession. The prices of large regional banks fell precipitously as investors indiscriminately sold shares, allowing us to significantly increase our exposure at fire-sale prices. At the time, market sentiment did not distinguish between Held To Maturity (“HTM”) vs. Available For Sale (“AFS”) securities unrealized losses, which presented us with a unique opportunity. While other market participants viewed the AFS unrealized losses as an undesirable risk, we viewed them as a juicy source of future upside as the losses naturally reverse with time. We were correct. These investments have increased significantly in value since then. Taking into account recent price appreciation, we estimate this basket (through the combination of AFS unrealized loss reversals, profitable earnings yields, and valuation multiple expansion) will generate ~2.0X in the next 3 years. See our 2023 1st Quarter Letter for our Regional Bank investment thesis.

Energy Infrastructure / Master Limited Partnerships (MLPs): 22% NAV

Energy infrastructure companies with assets indispensable to the smooth function of modern society. These investments were made in early 2020, taking advantage of commodity price volatility, shareholder turnover, forced selling, and uncertainty related to the long-term demand of fossil fuels which drove prices to extremely low levels. Since then, geopolitical strife, inflation, and increased recognition of the limitations of renewable energy has led market participants to reembrace fossil fuels, which in turn has lifted the prices of our MLPs. The size of this allocation peaked at 42% of NAV in late-2021, and has since gradually declined due to harvested gains, trimmed exposures, and M&A activity. MLPs remain a cornerstone of our portfolio given favorable industry demand dynamics, stable cash flows, conservative balance sheets, reasonable valuations (at ~10x Cash Flow), and generous cash distributions. See our 2019 4th Quarter and 2021 2nd Quarter Letters for our MLP investment thesis.

Reinvestment Growth (Payments & Financial Technology): 15% NAV

Fast-growing payments & financial technology businesses with favorable revenue tail winds, operating in areas with vast untapped total addressable markets, generating cash profits, actively reinvesting profits back into the business at high incremental margins, and self-funding future growth with little/no equity dilution. We purchased these investments at attractive prices that should generate at least 3X return in 5 years based on reasonable topline growth & margin assumptions. This allocation will increase in size over time as market volatility presents us with buying opportunities. See our 2022 1st Quarter Letter for more details.

Cash & Cash Equivalents: 40% NAV

This category will fluctuate depending on investment opportunities available in the marketplace. We collect ~4% interest and dividends per year which continuously replenishes our cash balance.

Target Portfolio Allocation % Over Time

Portfolio Return* Analysis & Future Positioning

The portfolio* appreciated 8.1% (NET) in the 3rd quarter of 2024, bringing our year-to-date (YTD) 2024 return to +14.3% (net).

Portfolio gains YTD were fueled by our investments in large-cap financials and energy infrastructure MLPs, contributing 48% and 39% of our YTD $ gains, respectively. During the quarter, we harvested substantial gains.

- Energy Infrastructure MLPs:

- We sold ENLC after OKE purchased 43% of ENLC at $14.90/share and announced its intention to buy the rest before year end. Our average cost basis for ENLC was ~$2.66/share and we received ~$1.74/share of dividends. Needless to say, ENLC was a very large and highly lucrative investment.

- We also exited the preferred stock of Summit Midstream at $147 vs. our original purchase price of ~$15 in 2020, another highly lucrative investment.

- Large-cap financials: we exited our investments in COF (41% total return, 52% annualized), CMA (38% total return, 24% annualized), and KEY (52% total return, 31% annualized) as valuations have recovered from the bleakest days of March 2023.

Higher interest rates and equity valuations combined with growing geopolitical tension (in the Middle East, Russia/Ukraine) and macroeconomic uncertainty (China is showing disturbing signs of economic recession and deflationary spiral1) led us to prudently trim portfolio exposures in areas where valuations have recovered, and risk-reward propositions became less attractive.

Pro forma for recent sales, our portfolio cash has increased to ~40% NAV. This balance earns ~4% annual interest, is readily available for deployment into attractive future opportunities while offering downside protection. The future return potential of our current portfolio remains undiminished because our remaining investments have plentiful upside. We have also creatively tucked into the portfolio small, yet powerful sources of return enhancement.

For Example: PSFE Warrants — A Creative Inflation Hedge

Paysafe (PSFE) is a payment technology company catering to merchants in Online Gaming & Betting, Travel & Leisure, Retail & Hospitality industry verticals. It came public as a SPAC in 2020 and experienced shareholder abandonment and forced selling over the next 2 years – a proverbial baby thrown out with the “SPAC Crash” bathwater. Our knowledge of the payment and financial technology industry led us to form a differentiated opinion from those rushing to exit, and we were happy to purchase their shares in both the common equity and warrants.

The underlying business of PSFE is growing, solidly profitable with high margins, and generates healthy amounts of free cash flow. Leverage is high, but the debt is covenant lite, and 90%+ of the principal value is not due until after 2027.

The risk-reward proposition for both PSFE common equity and warrants is highly attractive. Given the revenue growth and margin expansion potential of the business, PSFE common equity, currently sized at ~3% of NAV, is conservatively worth ~$50+/share vs. our cost of ~$13.50/share.

We also hold a small position in PSFE warrants, currently sized at 0.2% of NAV. These warrants are essentially very attractively priced inflation hedges for our portfolio. In a scenario where global price inflation is untamed, PSFE would experience a strong tailwind given its ad valorem revenue model (% of $ transaction volume), leading to topline growth, margin expansion, and much higher free cash flow generation. Its high debt load becomes easier to repay and would function as a compressed spring for the equity price to explode higher, bringing the $138/share warrant strike price within reach. $1- 2/share in the money would equate to ~50 to 100X+ return on the warrant currently trading at

~$0.02/share, thus providing us with an extremely attractive inflation hedge.

Looking Forward to History Repeating

“The word is about, there’s something evolving / Whatever may come, the world keeps revolving They say the next big thing is here / That the revolution’s near

But to me it seems quite clear / That it’s all just a little bit of history repeating… And I’ve seen it before / And I’ll see it again

Yes I’veseenitbefore /Justlittlebitsofhistoryrepeating.”

– “History Repeating” by Propellerheads

Technology, fashion trends, etc. may change over market cycles, but human psychology – the product of tens of thousands of years of biological evolution – does not alter so quickly.

Market prices (and even algorithms) are ultimately set by humans with psychological tendencies. Their collective psychology creates booms with unjustifiably high prices as well as the inevitable busts with irrationally low prices. Our investment strategy of patient opportunism is designed to capitalize upon the tendency of this human collective psychology to create boom-bust cycles in various asset classes or sectors within the economic landscape.

Over the past 14 years, the public markets have repetitively gifted us with boom-bust cycles of which we have successfully taken advantage. The lucrative investment decisions that have powered our returns since inception have all shared the following commonalities:

- Fear-induced panicked selling for an identifiable reason

- Separation of wheat vs. chaff through diligence and deep industry knowledge

- Diversified basket approach

- Price recovery once fear fades and rationality return to market participant behavior

If we remain patient – for worthwhile opportunities to emerge, and for rationality to return

and prices to recover – human psychology will invariably provide us with future sets of lucrative opportunities, over and over again. The types of opportunity sets may differ, but the underlying rationale for our investment will be familiar because our dedication to patient opportunism remains ever-constant, serving as the blueprint to accomplish our goal to grow wealth over a long-term horizon.

Please do not hesitate to reach out with any questions. As always, thank you for your trust. We look forward to continuing our capital compounding adventures in the years ahead.

Yours very truly,

Vivian Y. Chen, CFA Portfolio Manager

Marram Investment Management

Appendix: Historical Performance Returns (Net Of Fees)*

|

CalendarYear |

Marram (Net of Fees) |

S&P 500 (TotalReturn) |

% Difference |

|

2011 |

22.3% |

2.1% |

+20.2% |

|

2012 |

34.7% |

16.0% |

+18.7% |

|

2013 |

27.3% |

32.4% |

-5.1% |

|

2014 |

13.3% |

13.7% |

-0.4% |

|

2015 |

-9.1% |

1.4% |

-10.5% |

|

2016 |

38.5% |

12.0% |

+26.6% |

|

2017 |

22.1% |

21.8% |

+0.3% |

|

2018 |

-17.3% |

-4.4% |

-12.9% |

|

2019 |

-1.7% |

31.5% |

-33.2% |

|

2020 |

23.7% |

18.4% |

+5.3% |

|

2021 |

34.0% |

28.7% |

+5.3% |

|

2022 |

3.2% |

-18.1% |

+21.3% |

|

2023 |

12.9% |

26.3% |

-13.4% |

|

2024 YTD |

14.3% |

22.1% |

-7.7% |

|

CumulativeReturn% |

555.9% |

496.3% |

+59.6% |

|

AnnualizedReturn% |

14.7% |

13.9% |

+0.8% |

|

Footnotes 1China is increasingly restricting the flow of information and people, and news coverage is spotty as very few foreign journalists remain in the country. The economic anecdotes gleaned from friends and family still living in China is not encouraging. Unemployment is rampant, domestic business and consumer confidence is low, real estate values are cratering, factory utilization is tepid as foreign investment and supply chains continue to move elsewhere, and bad debts glut the balance sheets of domestic banks. Government response is dysfunctional, hampered by centralized decision- making, political paranoia, and self-preservation in the new Xi-Maoist era. |

Disclosure

|

* Unaudited, net return figure calculation assumes 2% per annum management fee, pro-rated and deducted monthly from performance of the portfolio manager’s taxable separate account which does not pay management or performance fees. This separate account most accurately reflects the long-term investment strategy of Marram Investment Management. Remaining separate accounts were purposefully omitted as they may deviate from the strategy due to fee structure, custodial & trading expenses, fund transfer & order timing, margin & trading capabilities, tax considerations, and other account restrictions. Returns for each separate account may differ. Please refer to your account statements for actual net return figures. Returns presented for S&P 500 include dividend reinvestment. While the S&P 500 is a well-known and widely recognized index, the index has not been selected to represent an appropriate benchmark for Marram’s investment strategy whose holdings, performance and volatility may differ significantly from the securities that comprise the index. Investors cannot invest directly in an index (although one can invest in an index fund designed to closely track such index). Historical performance is not indicative of future results. An investment is speculative and involves a high degree of risk and possible loss of principal capital. All information presented herein is for informational purposes only. No investor or prospective investor should assume that any such discussion serves as the receipt of personalized advice from Marram. Investors are urged to consult a professional advisor regarding the possible economic, tax, legal or other consequences of entering into any investments or transactions described herein. A list of all recommendations made by Marram within the immediately preceding period of not less than one year is available upon request. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities on this list. Specific companies or securities shown are meant to demonstrate Marram’s investment style and the types of companies, industries, and instruments in which we invest, and are not selected based on past performance. The analyses and conclusions include certain statements, assumptions, estimates and projections that reflect various assumptions by Marram concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies, and have been included solely for illustrative purposes. No representations, express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections, or with respect to any other materials herein. |

Read the full article here