What Happened

The MSCI China All Shares Index climbed 22% in the third quarter. The market surged nearly 25% in the final eight trading days of the quarter in response to a large monetary stimulus package announced by the People’s Bank of China, which also included support for the floundering property sector and initiatives to boost stock market returns.

While other policy measures have been introduced over the past two years, the scope and coordination of the latest moves are unprecedented, suggesting that China’s policy stance may have shifted as deflation has become more entrenched. Key announcements on monetary easing included a 50 basis point (bps) reduction in the reserve requirement ratio, releasing RMB 1 trillion ($142 billion) for new lending, along with indications of a further 25-50 bps cut by year end. The Chinese Central Bank is also reducing its policy rate (seven-day reverse repo rate) which will decrease lending rates.

Measures were also announced to stabilize the real estate sector and halt the decline in housing prices. These consist of a 50 bps cut in mortgage rates for existing home owners, expected to benefit 50 million households, and lowering the downpayment ratio for second home buyers from 25% to 15%. Finally, new policies aimed at boosting stock market valuations include RMB 500 billion in swap facilities for brokers and asset managers to aid in stock purchases, and RMB 300 billion in re-lending facilities for commercial banks to assist in funding listed companies’ buybacks. These announcements led to a significant rally in the Chinese market, returning it to levels last seen in the first quarter of 2023 during the COVID reopening period.

Every sector posted positive returns this quarter. Consumer Discretionary fared best, rising more than 35%. Beaten-down stocks of e-commerce companies such as Alibaba (BABA), JD.com (JD), and MSCI China All Shares Index Performance (USD %)

Meituan rallied sharply along with automobile manufacturers on anticipation of higher spending by Chinese households, The Real Estate sector also performed well, buoyed by announcements of mortgage rate cuts and lower downpayment requirements. Financials saw significant gains, especially securities brokerage firms which should benefit from policies encouraging stock purchases. Insurers also benefitted from expectations of higher investment returns in a rising market.

While other policy measures have been introduced over the past two years, the scope and coordination of the latest moves are unprecedented, suggesting that China’s policy stance may have shifted as deflation has become more entrenched.

By style, low-quality companies continued to meaningfully outperform high-quality firms. The lowest quintile of quality outperformed the highest quintile by more than 12 percentage points.

How We Did

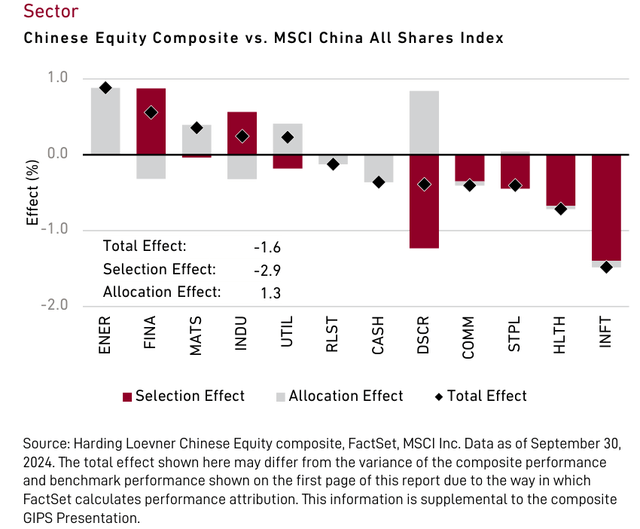

The Chinese Equity composite rose 20.7% gross of fees in the third quarter, compared with the 22.5% rise of the MSCI China All Shares Index. Performance in Information Technology and Health Care were the primary causes of the portfolio’s relative shortfall.

|

Sector |

3Q 2024 |

Trailing 12 Months |

|

Communication Services |

17.7 |

29.6 |

|

Consumer Discretionary |

35.4 |

25.8 |

|

Consumer Staples |

22.6 |

0.7 |

|

Energy |

0.9 |

29.2 |

|

Financials |

25.2 |

32.4 |

|

Health Care |

27.2 |

-4.2 |

|

Industrials |

19.6 |

21.5 |

|

Information Technology |

19.3 |

14.8 |

|

Materials |

13.2 |

13.8 |

|

Real Estate |

30.5 |

-0.6 |

|

Utilities |

3.3 |

32.6 |

|

Source: FactSet, MSCI Inc. Data as of September 30, 2024. Companies held in the portfolio at the end of the quarter appear in bold type; only the first reference to a particular holding appears in bold. The portfolio is actively managed therefore holdings shown may not be current. Portfolio holdings should not be considered recommendations to buy or sell any security. It should not be assumed that investment in the security identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner. A complete list of holdings at September 30, 2024 is available on page 6 of this report. |

The portfolio was helped by its underweight to the Energy sector, a meaningful laggard.

In Information Technology, shares of Delta Electronics (OTCPK:DLEGF) declined on weaker sentiment for AI stocks despite the company reporting strong earnings. Laser equipment manufacturer Bochu also fell.

In addition to concerns about pricing pressure and the impact of recent policy easing on demand, management disclosed a significant slowdown in third quarter growth, primarily due to China’s deteriorating macro environment. Semiconductor equipment manufacturer ASM Pacific Technology (OTCPK:ASMVF) posted weak performance due to the slow recovery in the company’s legacy packaging business, despite anticipation of higher orders in advanced packaging equipment from the boom in AI chip manufacturing.

In Health Care, two of our three holdings lagged. Medical equipment manufacturer Mindray and storage manufacturer Haier Biomedical experienced a pullback due to delays in local government funding for new hospital purchases. These more than offset gains from Tigermed (OTCPK:HNGZY), a clinical development services company, which reported double-digit year-over-year backlog growth due to solid demand from non-Chinese clients to conduct clinical trials in China.

Third Quarter 2024 Performance Attribution

On a positive note, Techtronic Industries (OTCQX:TTNDY) gained on continuing growth of the company’s professionally oriented Milwaukee tool brand, as well as from rising sentiment spurred by the interest-rate easing cycle.

What’s On Our Minds

In the first eight months of 2024, the average selling price of existing homes in China fell by 5.8%, reaching a 14.6% decline from their peak in 2021. This drop in real estate values has led to subdued consumer spending across the Chinese economy. However, domestic sales of certain consumer appliances have remained strong, supporting operating fundamentals and the shares of home appliance manufacturers such as Midea Group, the leader in air conditioning sales, and Haier Smart Home (OTCPK:HRSHF, Haier), a dominant maker of refrigerator and washing machines.

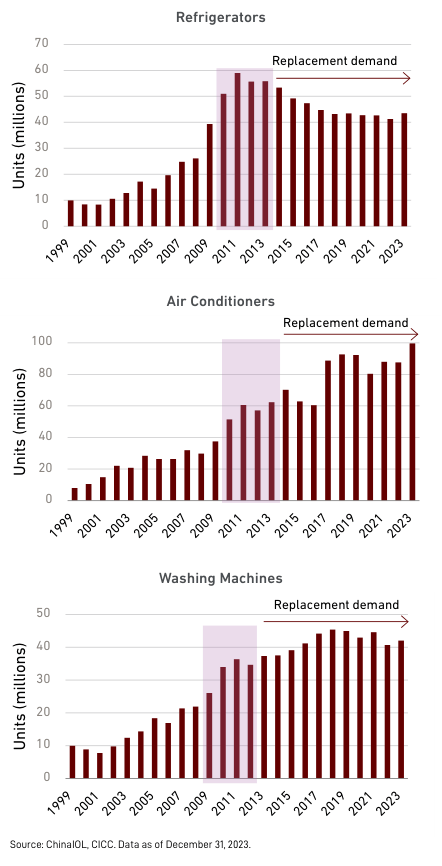

The resilience of sales of home appliances such as washing machines and air conditioners stems from a change in the underlying source of demand for these products. Before 2011, outfitting new homes accounted for over 70% of appliance demand but now constitutes only 20% because penetration is already high. Today, sales are being buoyed by consumers opting to upgrade or replace old units.

To some extent, home appliance sales in the prior decade were boosted by nationwide government programs such as “Home Appliances Going to the Countryside” and “Trade-in for New Appliances.” Those units are now coming due for replacement after more than 10 years of service, exceeding their designed lifespans of 8 to 10 years. A new government trade-in program that provides consumers who exchange their outdated appliances with subsidies equal to 15-20% of retail prices encourages consumers to replace their older units, especially at a time when consumers may be reluctant to spend on large ticket items in a weak economy.

Another key reason for resilience in home appliances sales stems from the government’s sustainability initiatives. China’s federal green energy initiatives have pushed companies such as Midea and Haier to focus more on developing energy-efficient and smart products. For instance, Haier now offers more washing machines and refrigerators with Level 1 energy efficiency (the highest) than many industry peers. The push for better products has worked— from 2000 to 2020, the average energy efficiency of household appliances in China improved by more than 40%. The 2024 trade-in subsidy is particularly larger for energy- or water-efficient products, as much as 20% of the product’s retail price.

Sales of refrigerators, washing machines and air conditioning units are being supported by replacement demand Refrigerators

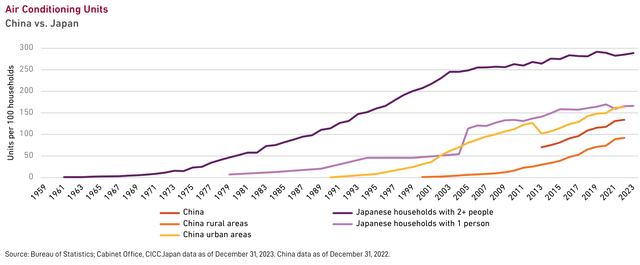

While upgrades are fueling home appliance demand today, there is also room for future growth in per capita appliance ownership in China. In China, air conditioning systems are typically one-room units, known as split or wall-mounted systems, unlike the centralized systems that dominate the U.S. market. While most U.S. homes rely on a single central unit to cool multiple rooms, apartments and homes in China often require individual AC units for each room, similar to the setup in Japan. In 2022, Chinese households had 134 air conditioners per 100 households, similar to single-person households in Japan but below the number in Japan’s multi-person households (282 units per 100 households in 2017). Pandemic lockdowns from 2020 to 2022 underscored the need for residential comfort, especially in rural areas where air conditioning is less prevalent. Midea is well positioned to meet rising demand in rural markets, due to its extensive product range including some more affordable lines.

The resilience of sales of home appliances such as washing machines and air conditioners stems from a change in the underlying source of demand for these products. Today, sales are being buoyed by consumers opting to upgrade or replace old units.

Midea and Haier have also benefitted from the expansion of their footprint beyond China, which has lowered their dependence on the Chinese market; each generates nearly half their sales internationally, and their international sales are growing faster than domestic sales. In both cases, the ability to expand beyond China has been made possible by the significant economies of scale and vertically integrated supply chains enjoyed by each firm. Not only do Midea and Haier assemble appliances, they also manufacture key components such as compressors and motors, enabling Midea and Haier to achieve higher margins and returns than industry peers. For example, Midea produced 125 million compressors in 2023, accounting for half of global demand, with nearly every other brand sourcing this critical component from Midea. The robust cash flows stemming from this model also fund substantial research and development budgets, around $2 billion for Midea and $1.5 billion for Haier in 2023, while global rivals such as Whirlpool have cut R&D spending in recent years.

Haier’s international expansion was cemented with its purchase of General Electric’s appliance division (GEA) in 2016, and the GE brand has since been revitalized. GEA, headquartered in Kentucky, operates as a standalone entity company within the Haier Group. This has fostered a culture of innovation different than what it experienced as a subsidiary within a large industrial conglomerate, with Haier empowering GEA to pursue new initiatives and reinvest in product development. Ranked seventh in the US appliance market before the acquisition, GEA is now among the market leaders as measured by sales, placing between first and third depending on the ranking entity. GEA has also been leveraging Haier’s technology in product development. This has enabled GEA to diversify the product offering beyond refrigerators and dishwashers, for which they were historically known. For example, GEA’s laundry division has grown by 17% due to the incorporation of Haier’s top-load technology in their washing machines.

Midea also expanded its international footprint through strategic acquisitions. In 2017, it acquired Welling Motor, the world’s largest manufacturer of air conditioner motors, enhancing its control over these crucial components. It acquired Clivet in Italy and Arbonia in Switzerland for greater market access in Europe where distribution channels often pose a barrier to entry. Midea also bought Toshiba Lifestyle, to bolster its presence in Southeast Asia and the Middle East.

This year, Midea and Haier’s shares have also benefitted from each company’s commitment to shareholder returns, directing their strong free cash flows to shareholders. Both firms have steadily increased their dividend payouts, with Midea now distributing more than 60% of profits and Haier more than 45%. Additionally, each company has authorized share repurchase plans, signaling confidence in future growth. The disciplined approach to capital allocation, which predates the government’s specific push for better shareholder returns last year, reflects a broader trend among listed companies in China toward enhancing shareholder value.

Both Midea and Haier’s commitment to product development, their expanding international footprint, and focus on shareholder returns sets them apart as leaders in the appliance industry. With increasing demand for home appliances supported by government subsidies and rising international sales, these companies are well-positioned for future growth.

Read the full article here