Investment Thesis

Earlier in August, I covered Keysight Technologies, Inc. (NYSE:KEYS) with a Buy rating, in which I discussed the company’s market positioning and the favorable industry dynamics. In this article, I will be covering the recent updates after the quarterly result and my outlook on the company going forward. I believe Keysight Technologies can experience a return to growth in the second half of 2024 after facing several quarters of weaker performance in the recent past. While challenges like decreased demand and reduced capital spending in the Electronic Solutions business persist, I believe the opportunity for test equipment in R&D processes across Communication, Aerospace & Defense, Industrial, and Automotive markets remains largely unchanged. There is potential for growth in the Communication Solutions portfolio, particularly in areas like AI-ML and Open RAN testing. Keysight’s strong position in the test and measurement equipment market, along with efforts to increase recurring revenue, will support its recovery in the latter half of 2024, in my view.

Q4 Review and Outlook

KEYS reported revenue in line with expectations for the fourth quarter, but the overall commentary for fiscal year 2024 was disappointing. Challenges such as ongoing manufacturing weaknesses, macroeconomic factors, and customer reluctance to spend are all negatively impacting the company’s outlook for FY24. While the Aerospace and Defense (A&D) segment achieved record-high revenue with strong order demand, the Commercial Communications markets are still rebalancing, which is affecting the overall performance of the Commercial Solutions Group (CSG). Factors like customer inventory adjustments, macroeconomic conditions, and spending constraints are all contributing to the subdued performance in Commercial Comms. I don’t expect to see a significant improvement in this business segment until the second half of the year. Wireless orders remain steady, but there is incremental strength in the wireline segment due to factors like AI/ML and data center expansion.

The Electronic Industrial Solutions Group (EISG) continues to face challenges from manufacturing weaknesses and cautious customer spending. Demand for semiconductors is declining, and both the Automotive and General Electronics businesses are experiencing softness in their manufacturing divisions. Weakness in China is also impacting orders, particularly in the general electronics and semiconductor businesses, which have a higher exposure to the Chinese market.

I believe Keysight’s sales may have reached their lowest point in a demanding market environment, and there could be signs of stability and improvement in the second half of 2024. The company did perform slightly better than expected in fiscal 4Q, driven by increased demand in aerospace and defense. However, the company still faces challenges, as evidenced by a weaker-than-expected outlook for 1Q, excluding the impact of the ESI deal, with delays in orders from the semiconductor and manufacturing sectors. There are some positive signs, such as improved commercial communications orders, which could form the basis for a return to growth later in fiscal 2024.

Growth Delayed to 4Q24

Navigating the challenging demand environment has proven to be more difficult for Keysight than I initially expected. I now anticipate that the company’s return to full-year growth will be delayed until fiscal year 2025. Several factors are contributing to this delay, including weak fundamentals in semiconductor manufacturing and concerns about China’s economic situation, which are amplifying the decrease in spending in the communications sector.

The broadening slowdown in demand is causing further delays in Keysight’s path to growth, prompting us to lower analyst’s sales and EPS outlook. The Electronics and Industrial Solutions Group (EIS) is experiencing waning demand, primarily due to semiconductor capacity reductions and challenges in the Chinese market. Although the decline in the commercial communications segment may be nearing its bottom, it is likely to remain weak in the coming quarters, especially as key end markets like smartphones, wireless, and optical equipment continue to face difficulties.

Advancement of Autonomous Driving Technology Bodes Well For the Company

Keysight is well-positioned to benefit from various automotive technology advancements, which could lead to sustained sales growth in the mid-single-digit range over the coming years. Emerging trends like autonomous vehicles and electric vehicles provide opportunities for the company to leverage its expertise in wireline and wireless communications testing, its leadership in radar technology through its aerospace and defense division, and its comprehensive EV battery solution called Scienlab. The electric vehicle market is expected to grow rapidly, with a projected 29% compound annual growth rate till 2030, driven by favorable regulatory conditions. This rapid transition toward EVs and autonomous vehicles, coupled with automotive original equipment manufacturers and Tier 1 suppliers increasingly taking on in-house design and development, expands Keysight’s customer base and supports its growth.

Valuation

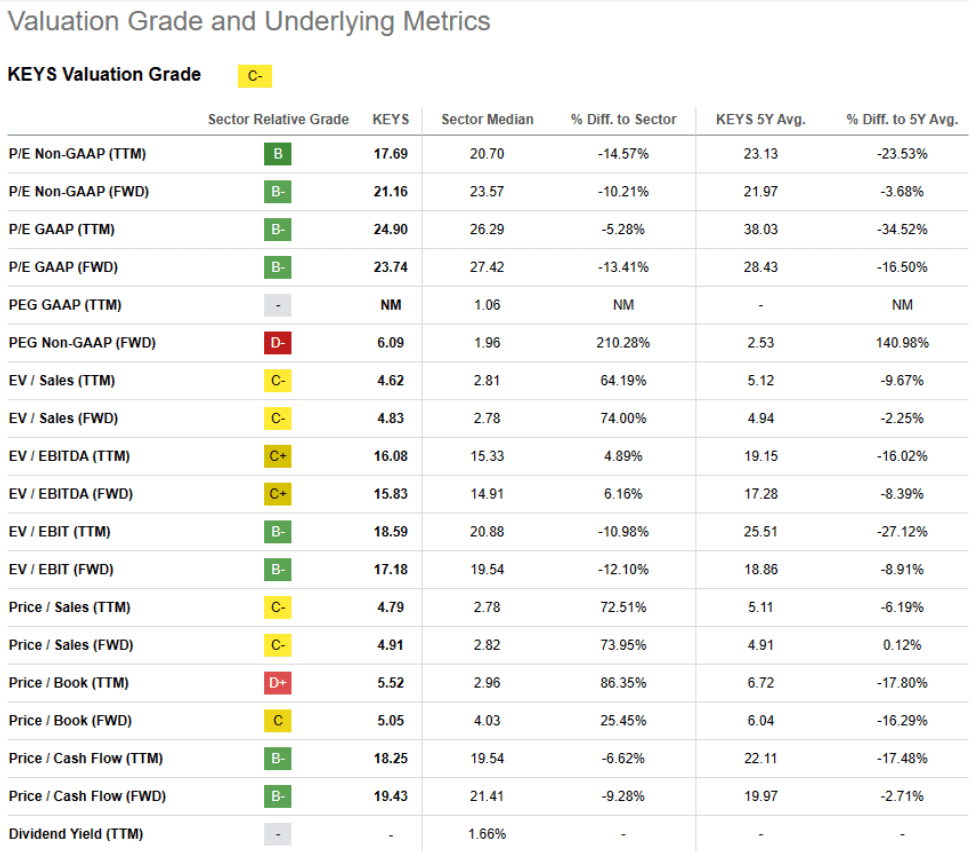

Keysight’s leadership in the test and measurement equipment market, its favorable position for spending growth, and strong free-cash-flow performance have resulted in a price-to-earnings ratio ranging from 18 to 21 times earnings, which is largely consistent with the S&P 500. The company’s successful product execution has allowed it to focus on faster-growing segments like electric vehicles, advanced wired and wireless communications, and advanced semiconductor manufacturing. Keysight is benefiting from the increasing prevalence of wired and wireless communications in various devices. Furthermore, the company is working on expanding its margins, which should contribute to profit and free cash flow growth, driving earnings per share faster than sales. The company is trading at a ~21x forward P/E, which is below the sector median, and I believe it is an attractive valuation to get in on the company. I believe a higher multiple is justified given Keysight’s technological leadership, exposure to multiple industry drivers, and its dominant position in the market.

Seeking Alpha

Investment Risks

There are some potential risks that should be taken into consideration, which could have a negative impact on the stock price. Firstly, there’s the risk of intense competition and the difficulty in gaining a larger market share over an extended period. This challenge could be exacerbated by a slowdown in the end-market and the deterioration of global macroeconomic conditions, which might influence how customers make purchasing decisions and plan their activities.

Another risk is the potential inability to sustain an increase in profit margins and recurring revenue, especially when it comes to boosting income from software sales and content. Additionally, fluctuations in component prices, whether they rise sharply or decline significantly, could pose difficulties in maintaining stable pricing.

Moreover, in the context of the test and measurement market, it’s crucial to note that it is highly fragmented, with numerous competitors, some of which are quite substantial and well-resourced, such as Anritsu and Rohde & Schwarz. This high level of competition, whether driven by the introduction of new products, shifts in strategy, or aggressive pricing tactics aimed at capturing market share, could potentially lead to a decrease in earnings compared to forecasts for companies operating in this sector.

Conclusion

Keysight Technologies, despite its leadership in 5G wireless, optical wireline, and automotive test equipment, may face challenges in maintaining its performance due to economic uncertainties. This could result in reduced order activity and a decline in sales in 2024 compared to its long-term growth target of 5-7%. However, I believe that this spending slowdown is temporary, and the company could experience growth again in the second half of 2024. This potential rebound is supported by Keysight’s strong presence in communication and industrial sectors, driven by positive trends like 5G/6G, AI, autonomous vehicles, and Industry 4.0. Keysight’s dominant position in the market, combined with its wide range of offerings, continues to help it gain market share in testing and measurement equipment. I remain optimistic on the company and maintain my buy rating on the stock.

Read the full article here